Mailcomms Group > Blog > Communication solutions with legal value > Page 7

Communication solutions with legal value

Nuestras noticias

The regulatory burden in the tourism sector: How can we help companies comply with different regulations?

We always talk about the unstoppable evolution of technology, but not so often do we talk about the development of the different legislations and the duties they imply for tourism companies and travelers. As a Regtech company, every day we face the challenge for organizations to comply with different legislations, some sectorial, others general... in any case, each one of them is the origin of a small or big internal revolution to adapt processes aimed at compliance. Technology once again becomes the perfect ally to comply with the regulations in a manageable way and to remove the reasonable fear of non-compliance and associated fines.Verify identity: 4-point checklist to check on any document

As more financial services become digitized, it is essential that financial institutions offer customers fast, reliable, mobile and online access to products and services. It often means rethinking the customer journey, particularly the stage at which the customer and the financial institution first establish a relationship - onboarding and account creation. Opening an account requires [...]We participated in the Regtech Conference “New technologies for regulatory compliance. Will you join us?

On May 5th we will participate in the Regtech Conference "New Technologies for Regulatory Compliance". This is a digital meeting focused on the technological possibilities available to companies to simplify and optimize their regulatory compliance tasks.Dynamic communications: a new way of dialoguing with your customers

In the era of digital transformation, the user expects something more from your company when interacting with it. Your customer wants to interact and get all the information they need, yes, but also to receive it in a clear, attractive and personalized way according to their needs and preferences. And this is where our dynamic communications solution comes into play.Guarantee, safety and quality of service: this is what our AENOR certifications prove.

Aenor has just granted us certification as a trust service provider in qualified electronic certified delivery service, in accordance with the eIDAS regulation for electronic identification and transactions. This accreditation joins others granted by the same entity, such as ISO 9001, ISO 27001 or ISO 27701, the latter in the process of being processed, to form a common context: the quality, security and guarantee of our services for our customers, ensuring legal compliance in the field of Personal Data Protection. In this article we explain them to you.Don’t let GDPR consent management ruin your call center calls

Obtaining express consent, in accordance with the requirements of the GDPR, is such a long and tedious process that it can lead to a poor customer experience and even abandonment of the call, which can result in a loss with great economic impact. In this post we propose an alternative management that speeds up the process thanks to the use of channels such as SMS and email during the call, through our CertySign tool.3 keys you need to know about the GDPR and its application in Spain

In a few months it will be three years since the date of mandatory application of the General Data Protection Regulation, and five years since its approval as a European regulation. If we look back to a few months before May 25, 2018, it is easy to remember the frenetic activity of all companies to adapt to the new regulations, much more protective and protective of the user than the previous one.Security by Design: security and privacy in the DNA of our platforms

Table of Contents Security by Design We build secure environments Cybersecurity within a multichannel communication management process is the pillar on which our technological developments are based. The trust that this generates in our clients and the real threat that cybercrime poses today are more than enough reasons for Security by Design to become our [...]MailTecK & Customer Comms increases its focus on legal communications in 2021

2021 is the year of legal communications for MailTecK & Customer Comms. This has always been one of the group's strategic lines, but during the year that has just begun, the focus will be intensified with special involvement of the product development department with the CertySign platform, reinforced by the incorporation of professionals in the areas of Product Marketing and Sales.Making the most of postal mail as part of a multichannel strategy

If anything has accelerated the global pandemic, it has been the corporate race to digitize. In times of confinement and social distancing, organizations have had to streamline their digital processes to satisfy a virtual customer, who has become no less demanding.Introduction to digital identity verification

The impact of the global pandemic has led to some unexpected changes in the financial, insurance and health services sectors-rather than halting operations, it has accelerated digitization efforts. While face-to-face activity may be restricted, individuals and businesses still need access to loans; homes and cars still need to be financed and insured; and healthcare providers need to be verified before enrolling in critical systems.Integrated design as the foundation of the digital transformation of omnichannel communications.

Digital transformation affects and optimizes all facets of a company, but some in particular. This is the case of communications with customers, even more so if these are carried out through multiple, interchangeable and synchronized channels and devices. That is, when we talk about omnichannel communications.Our participation in the AMAEF conference on document control, electronic signature and traceability in IDD

On Tuesday, December 1, we participated in a conference organized by the Association of Insurance Mediation of Financial Institutions (AMAEF).The power of customer journey orchestration

Table of Contents Customer experience has always been defined as the sum of all the interactions the customer has throughout his relationship with the brand. Journey mapping vs. journey orchestration Orchestration of the journey is a success differentiator How customers and brands benefit from journey orchestration Customer experience has always been defined as the sum [...]MailComms Group reinforces its commitment to blockchain and creates its own IPFS network

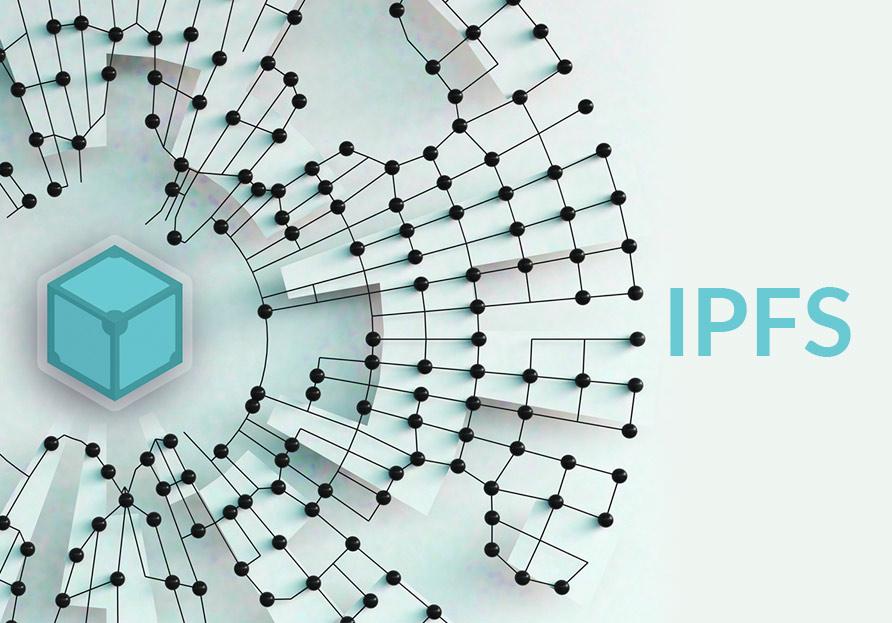

Our MailComms Technology team has created its own IPFS network to securely store your customers' files. IPFS or InterPlanetary File System, also known as Interplanetary File System, allows to store in a distributed network all kinds of information and documents quickly and securely with P2P technology, creating multiple copies of these documents in the different nodes that make up the network, betting on blockchain technology for companies.Te acompañamos en el camino de la transformación digital

CONTACTA CON UN ESPECIALISTA

AGENDA UNA CITA AHORA