Protect your business and your customers from identity theft and fraud

Certified electronic identification systems

Discover our digital identification service for your business

Secure identification of the individual contracting remotely is one of the most effective ways to minimize the risk of fraud in digital transactions.

This ability to verify unequivocally, reliably and remotely that the person contracting a product or service and accessing your systems is who they say they are, provides added security to transactions and acts as a barrier against fraud.

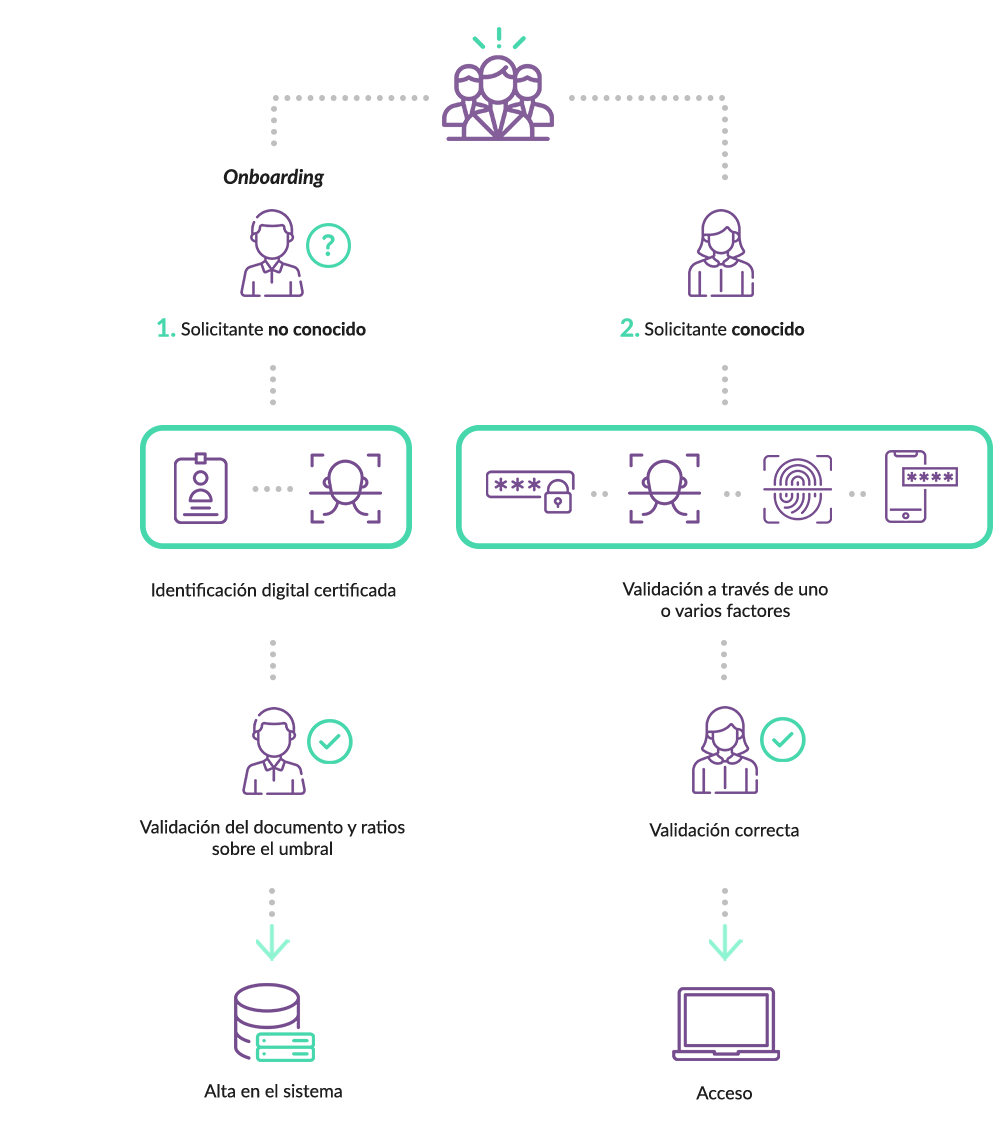

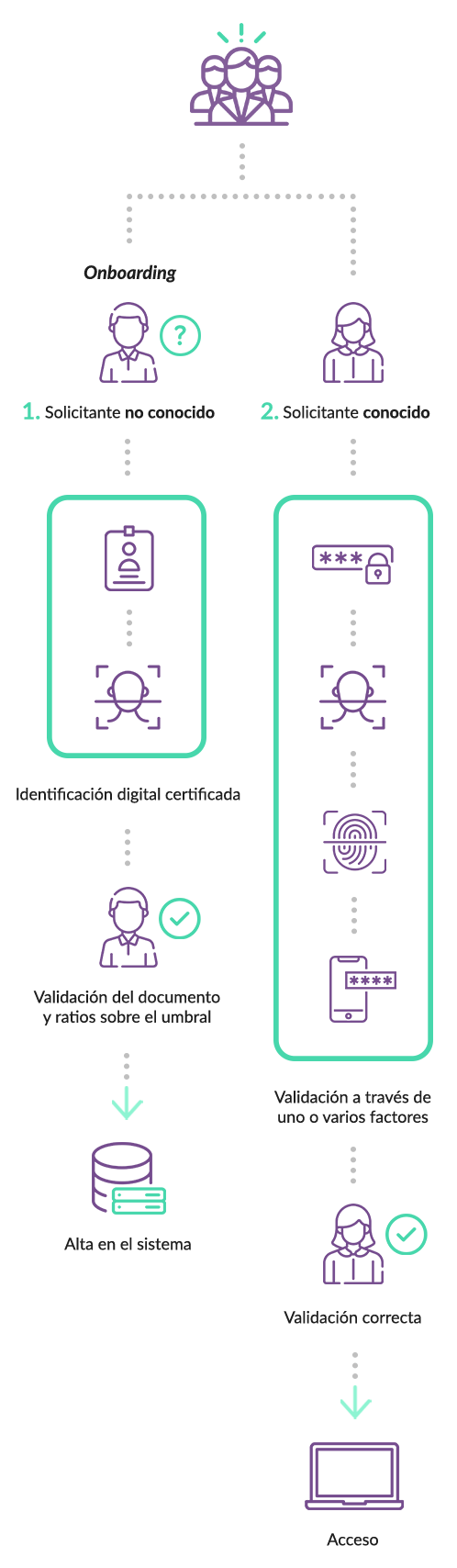

Both in theonboarding phase and in the user’s subsequent access to the contracted service, identity verification and authentication solutions must be robust and reliable to ensure the security of all parties involved.

Benefits of using our electronic identification systems

Reliable identification of customers and users in real time for onboarding processes or subsequent access to private areas.

Optimized customer experience with guidance to streamline onboarding processes and reduce abandonment rates.

Solutions for electronic identification with legal guarantees that minimize the risk of fraud due to identity theft, account theft or issuance of criminal transactions.

Possibility of developing multifactor authentication processes to maximize security in certified digital identification systems.

Solutions with security levels suitable for high-trust environments such as private banking areas or organizations with highly sensitive data.

Streamlining processes for contracting new products and services and reducing costs related to penalties and fraudulent transactions.

Learn about our certified digital identification solutions

Our services are essential and must be adapted to the nature of each business, service, type of transaction or general or specific legislation. At the same time, they must be integrated into an attractive user experience and, above all, not become an obstacle for users. Because of our technological, regulatory and multi-sectorial experience, we can offer you customized solutions to incorporate the most suitable option for each process.

Electronic identification and authentication in onboarding and onboarding processes.

access to secured services

WHITEPAPER

Do you need to verify and authenticate your customer’s identity to improve their experience?

In this document we tell you all the details.

I WANT TO DOWNLOAD ITDo you want to have a certified digital identification service with full legal guarantees?

Frequently Asked Questions

One of the main challenges today is to prevent cybercrime related to issues such as identity theft, the launch of fraudulent transactions or the theft of personal data, to give just a few examples. To avoid such cyber risks, the procurement of robust, secure and state-of-the-art certified digital identification services is crucial.

The main advantages include offering secure products and services to customers, avoiding identity theft and fraudulent transactions, speeding up customer onboarding processes, facilitating the contracting of products and services online, and obtaining benefits in terms of cost savings and sustainability.

They are varied and depend largely on the sectors in which companies operate, but some of the regulations that regulate certified digital identification or the need to implement these processes are eIDAS and eIDAS 2, the RGPD or PSD and PSD 2 in the field of financial services.

Electronic identification systems guarantee the security and privacy of user data when they are designed by certified technology providers and, especially, when these providers have been recognized as qualified providers of trusted electronic services by, in the case of Spain, the Ministry for Digital Transformation and the Civil Service.

In case your company needs to implement a certified digital identification process, please contact us.

Our specialized consultants will advise you on the different options and on the customization possibilities we can offer you to solve your company’s particular needs, with full legal, compliance and security guarantees, as well as an attractive user experience.