As of July 2025, several specific obligations established by the European anti-money laundering regulatory package, in particular the EU AML Regulation (Regulation (EU) 2024/1624) and the AML Directive6 (Directive (EU) 2024/1640), come into force .

Although the full transposition deadline extends to 2027 and a Royal Decree or Law amending Law 10/2010 has not yet been published to incorporate all the obligations arising from AML6 into the Spanish legal system, some obligations start to apply already from July 10, 2025 directly or require to be implemented by that date.

The Sixth Anti-Money Laundering Directive (AML6), proposed by the European Union as part of the new Digital Finance Package, marks a firm step towards a stricter and more effective harmonization of the legal framework in the fight against money laundering and terrorist financing. Below, we review its main new features, the sectors affected and how technology can become a key ally for compliance.

Main changes introduced by AML6

AML6 strengthens and broadens the scope of its predecessor (AML5), with substantial changes aimed at greater uniformity among the Member States:

- Uniform criminalization: AML6 requires all EU countries to criminalize 22 offenses related to money laundering, including arms trafficking, serious tax offenses, corruption and cybercrimes.

- Criminal liability of legal persons: Companies may be held criminally liable if they fail to prevent or detect laundering activities within their organization.

- Increased minimum penalties: The directive establishes minimum penalties of up to 4 years imprisonment for serious money laundering offenses.

- Increased cross-border cooperation: Mechanisms for the exchange of information between Financial Intelligence Units (FIUs) of member countries are strengthened.

Impacted business operations

The new provisions have a cross-cutting impact on numerous areas of operation, among them:

- Opening of bank accounts or financial products.

- Transfer of funds or digital assets.

- Incorporation of companies or purchase of real estate.

- Activities with a high volume of cash or cryptographic assets.

These operations will be subject to increased scrutiny, with enhanced due diligence (KYC) and documentation obligations.

Sectors required to apply AML6

AML6 expands the number of entities subject to legal obligations. To the traditional sectors (finance, insurance, real estate, lawyers and notaries) are added:

- Cryptoasset platforms and digital wallet providers.

- Crowdfunding companies.

- Dealers in art and high-value objects.

- Sports professionals and sports agents, in certain cases.

Penalties for non-compliance

The sanctioning framework is considerably toughened:

- Significant fines for legal entities (up to 10% of annual turnover or €10 million).

- Activity prohibitions, disqualifications and closure of establishments.

- Individual criminal liability for managers who fail to take reasonable preventive measures.

Compliance is no longer optional: negligence is no longer an excuse.

How technology can help compliance

In this context of increasing regulation, technology becomes essential to ensure agile and effective compliance. Two key tools are:

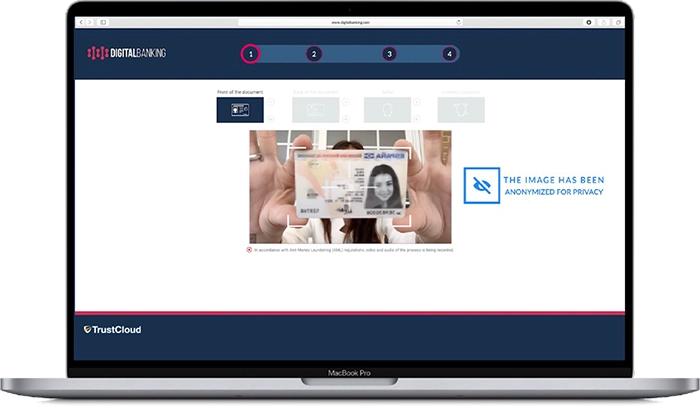

- Video-identification

Remote identity verification by video allows you to comply with KYC requirements in a secure, efficient and compliant way. It reduces fraud and speeds up customer onboarding, ensuring the traceability of the process.

- Certified communications

The use of certified communication channels (certified email, secure SMS, etc.) allows documenting every interaction with the client or partner, generating valid legal evidence for audits or inspections. It also facilitates the management of consent and the archiving of AML documentation.

Conclusion

AML6 reinforces the EU’s commitment to financial integrity, imposing greater demands for transparency, control and accountability. Companies must be prepared not only to comply, but to turn compliance into a competitive advantage. Incorporating technological solutions such as video identification and certified communications not only simplifies processes, but also increases the legal and operational security of the organization.