OneSpan Sign now includes

identity document verification

as a method of authenticating the signer to validate their identity before they have access to important contracts and agreements. Verification of a valid identity document provides a higher level of identification, ensuring that people are who they say they are and also offers anti-fraud protection in each company’s processes.

On the other hand, by combining enhanced identity verification with an e-signature solution, organizations streamline a wide range of financial services agreement processes, including account opening and onboarding processes, lending and vehicle financing, among others.

In the identity verification process, the signer is authenticated in real time through a photo of his/her passport or government-issued identity card and a selfie. Machine learning algorithms analyze the authenticity of the document provided and extract biometric data from the selfie to compare it with the photo of the DNI, NIE or passport. If successful, the user can access the documentation to sign and complete the process digitally.

In this post we will show you how to use identity verification in a mediated agreement scenario, with a bank advisor sending an account opening form to a client.

How to use ID verification in OneSpan Sign

Setting up a transaction for the verification of an identity document (sender)

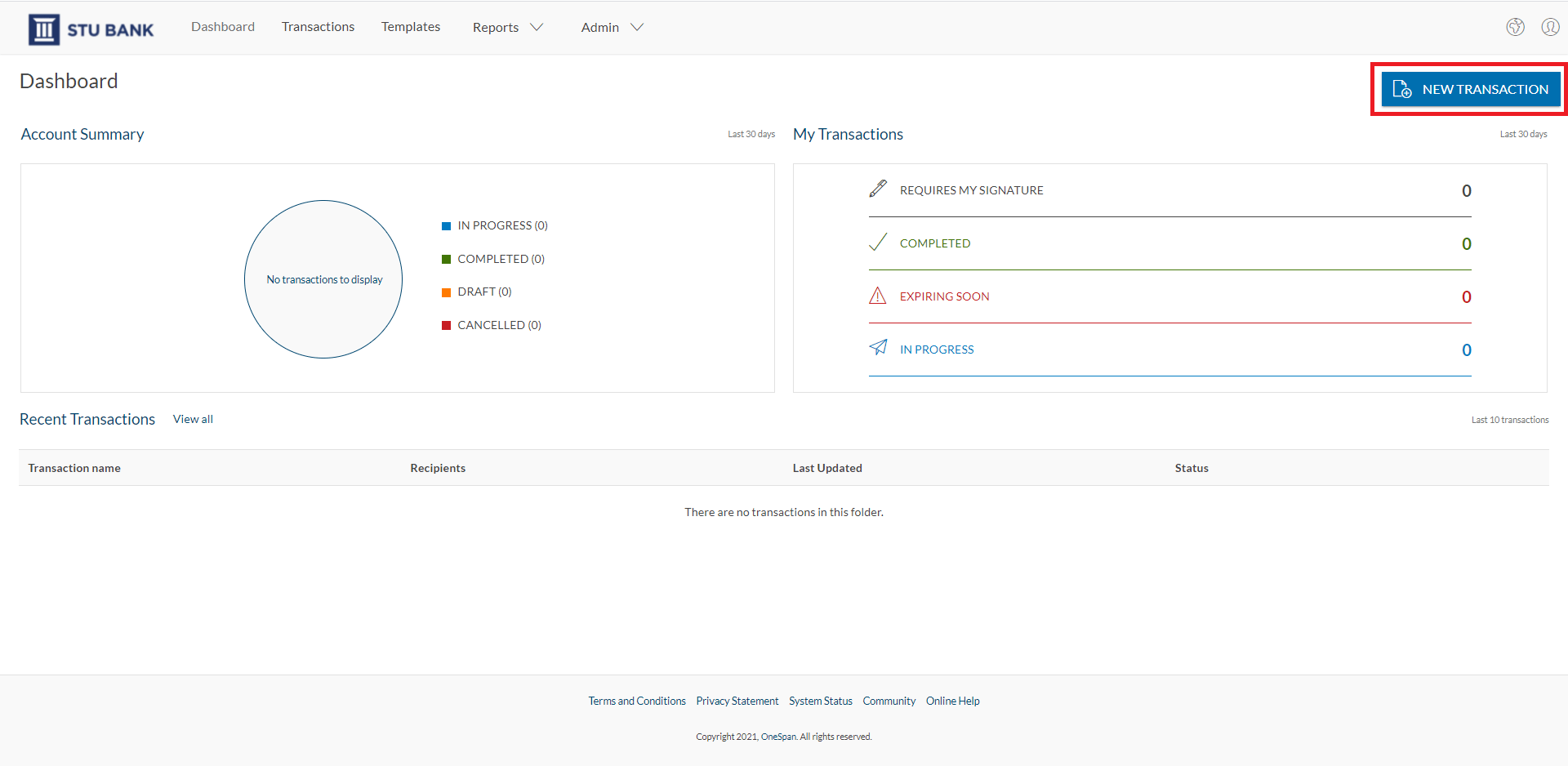

To begin, the advisor selects “New Transaction” and gives it a name.

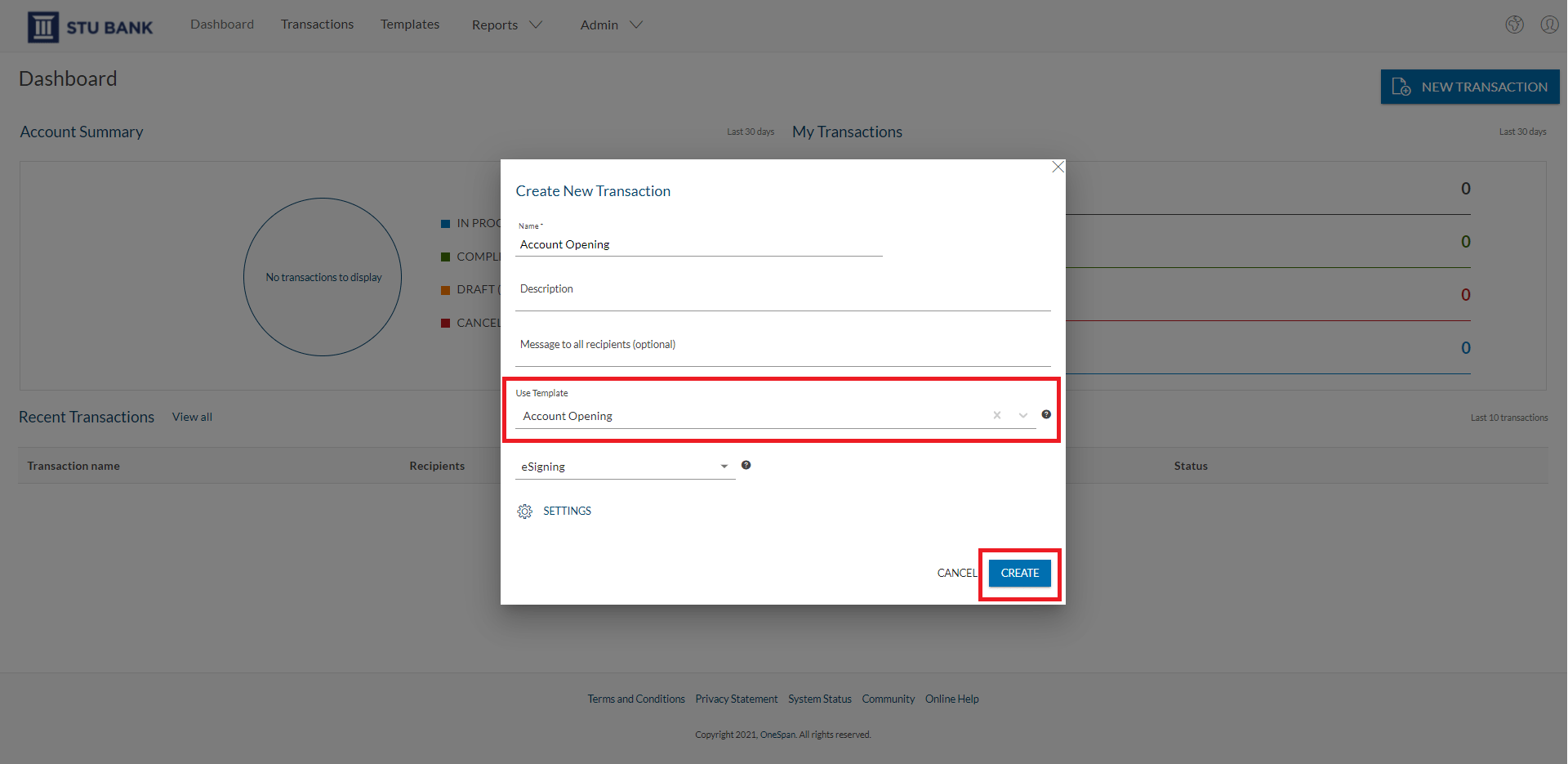

The professional selects a previously created template and clicks on the “Create” button to continue.

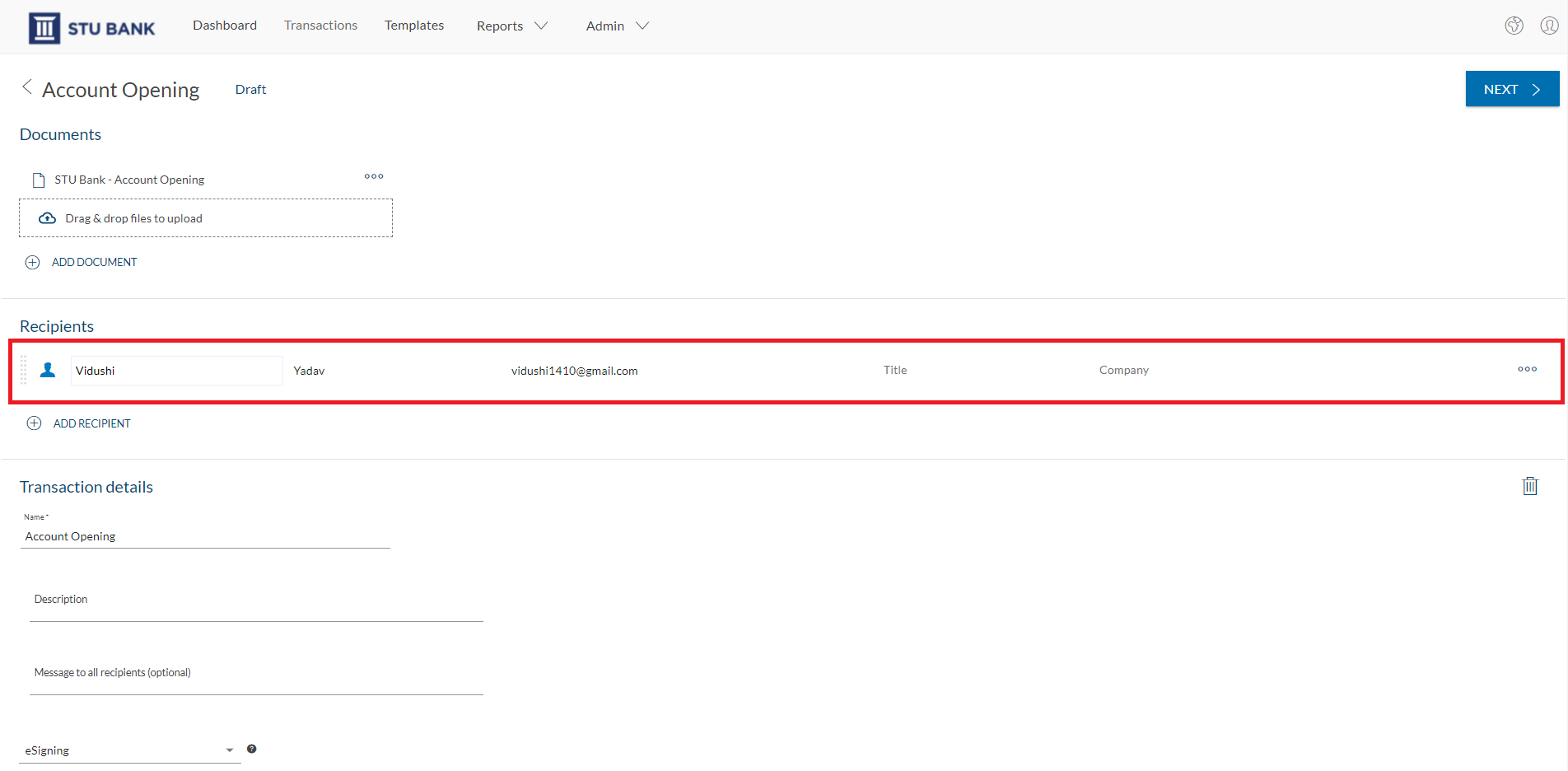

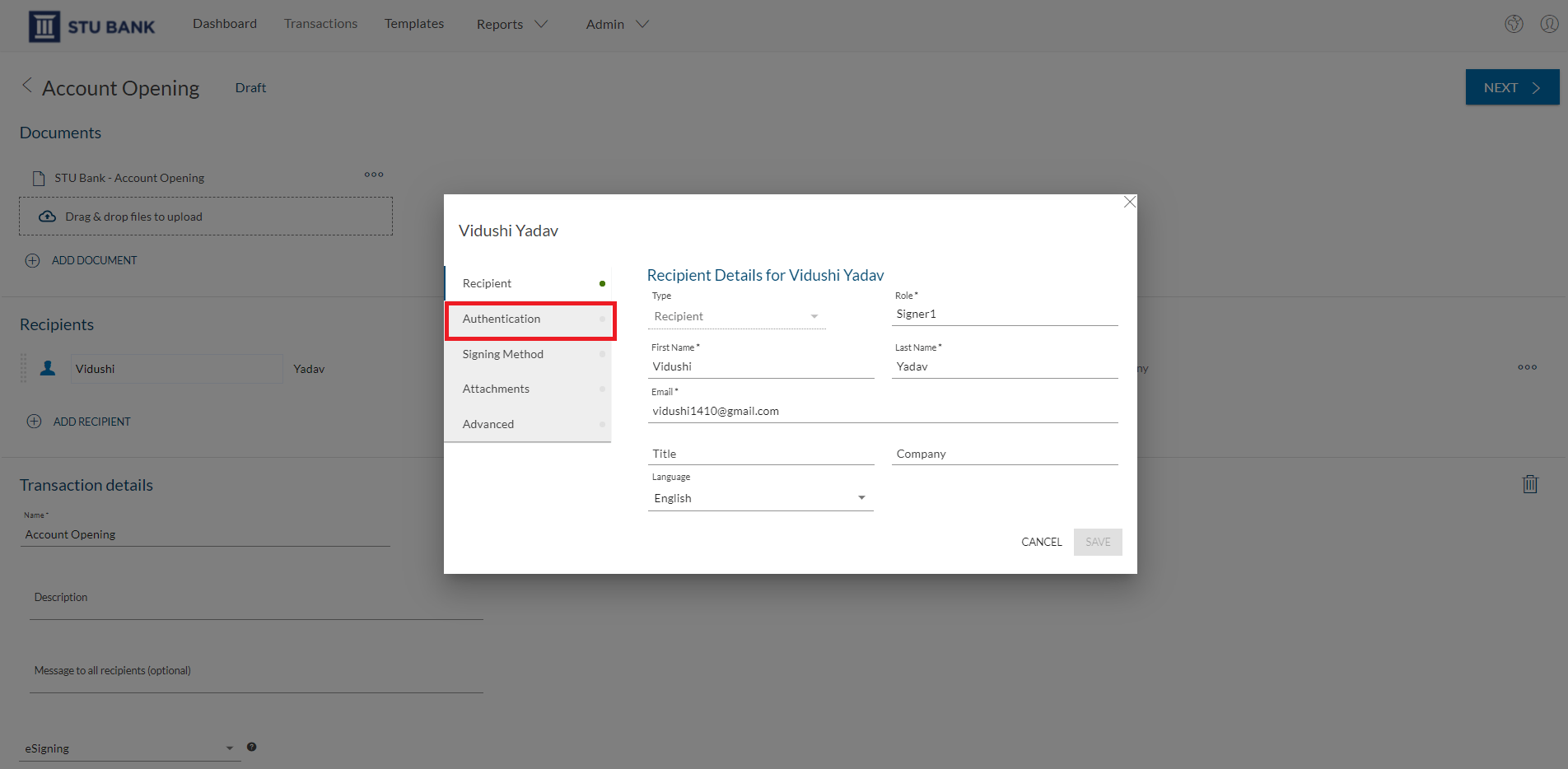

In this step, the advisor enters the data of the recipient who needs to electronically sign the account opening form.

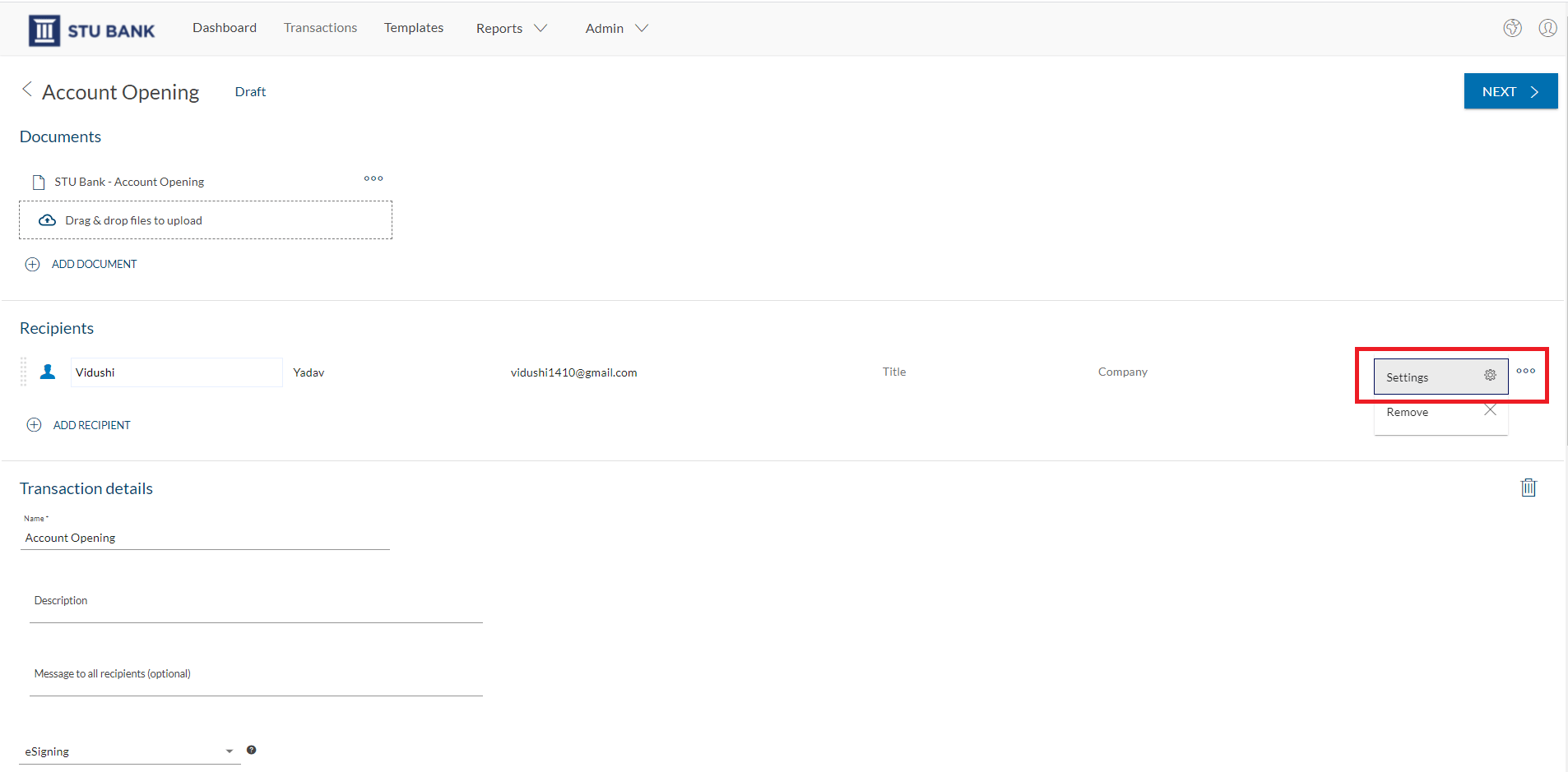

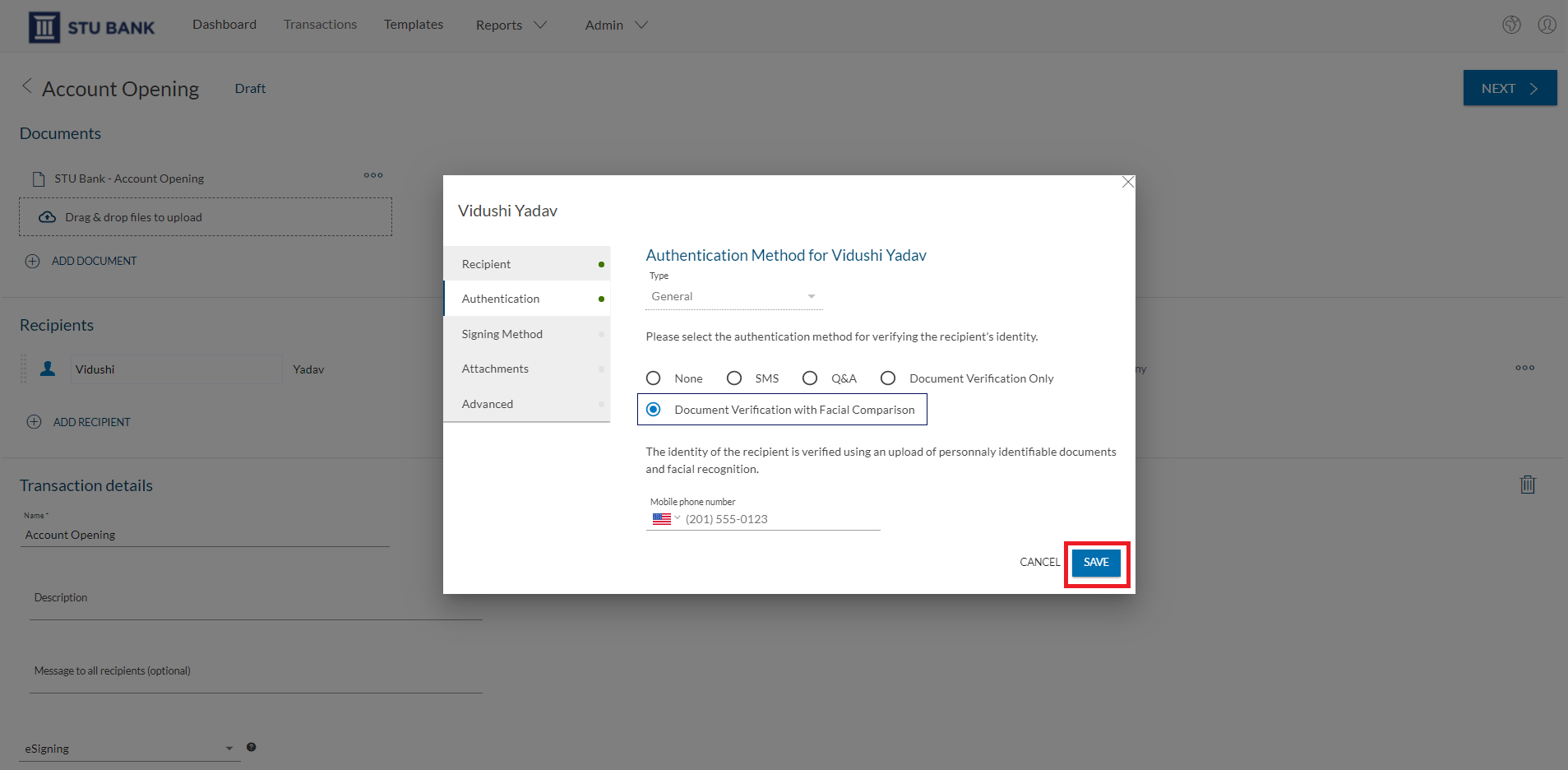

In the “Recipient Configuration” section, the consultant selects “Authentication”. There are several verification and identification options available in OneSpan Sign, such as email, SMS, Q&A, document verification only and document verification with facial comparison.

For identity verification, the bank professional has two options:

- Document verification only:allows the signer to validate his/her identity by means of his/her government-issued photo ID only.

- Document verification with facial comparison: the signatory validates his identity with his official identity document and a selfie, which is then taken and provides an additional layer of security in the process.

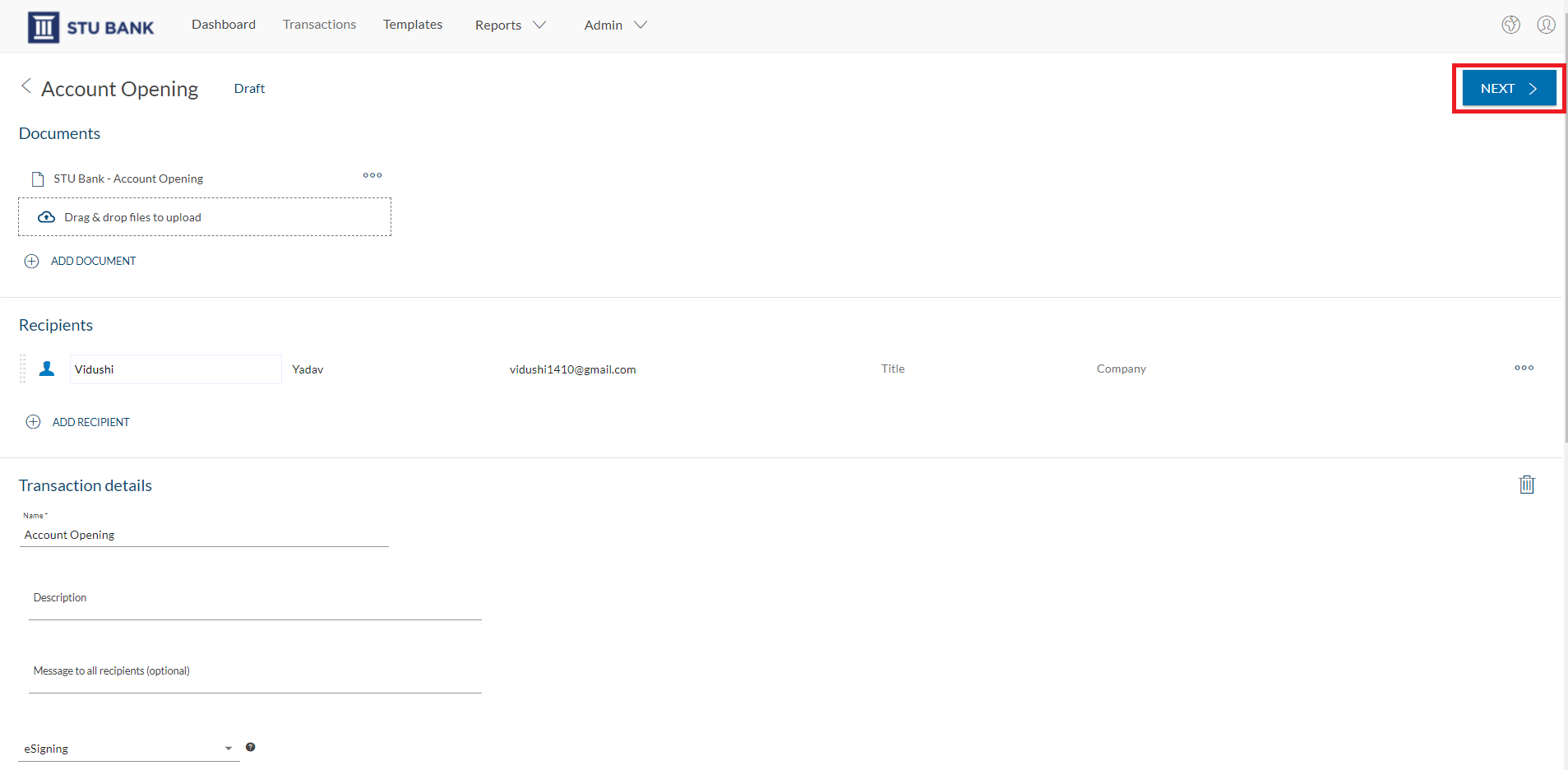

In this example, the bank advisor will select “Document verification with facial comparison” and then click “Save” and “Next”.

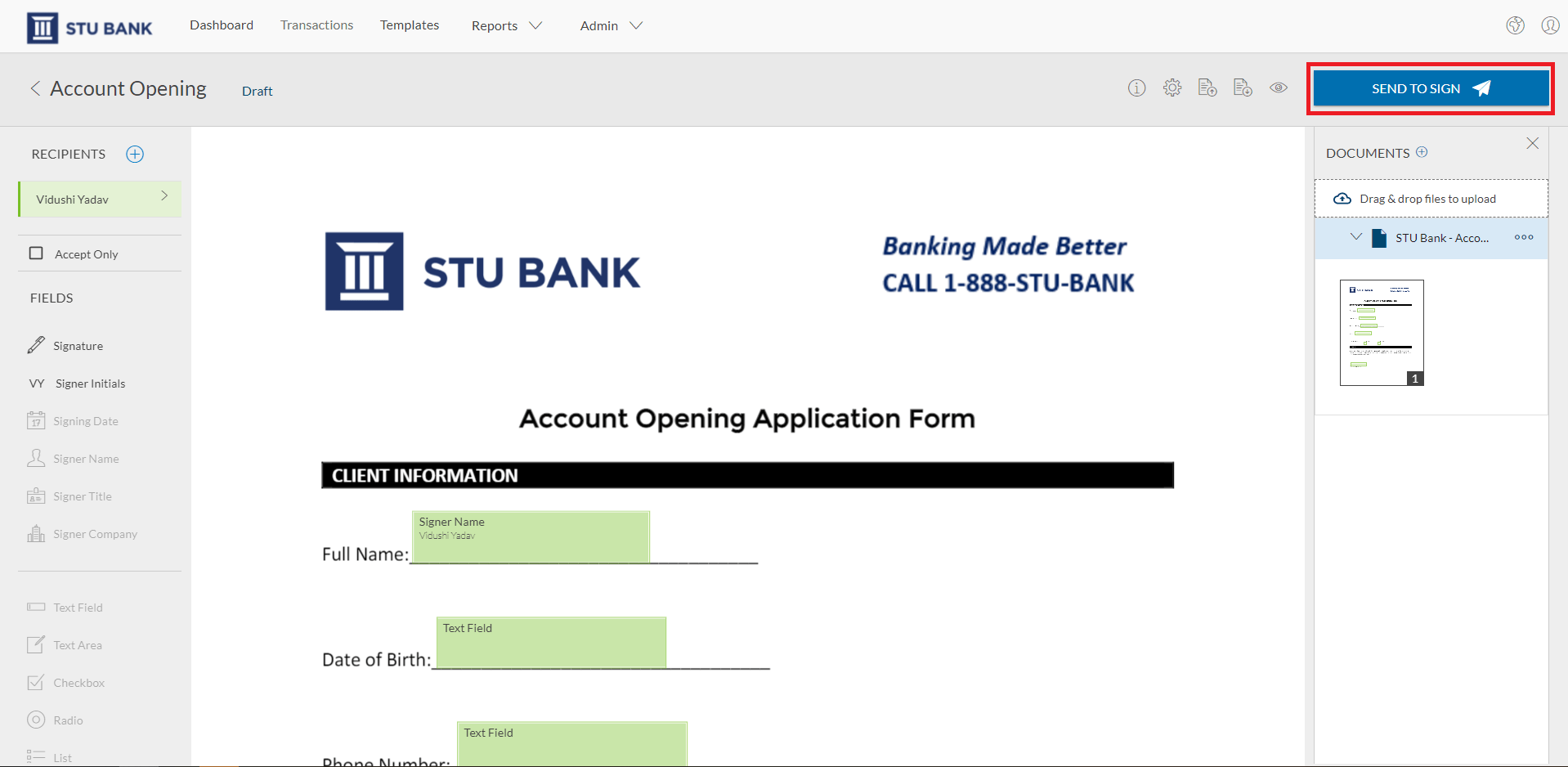

Once it is confirmed that all signature blocks are placed in the correct locations within the document, the transaction is ready. The advisor clicks on “Submit for signature” to submit the account opening form for signature.

Validation of identity documents and signature (signatory)

It is time for the signatory to validate his or her identity.

The signatory accesses the transaction from his/her e-mail and clicks on “Go to documents”.

A screen appears asking the signer to accept and consent to verify his or her identity.

The signatory then chooses the document he/she would like to verify and the country of issuance.

The user takes a photo of his/her ID and then a selfie to prove that the person presenting the ID is the same person whose image appears on the ID.

After successfully verifying your identity, click on “Continue with the signature” to access the documentation to be signed.

Once the signing process is complete, an audit trail is created that captures the details of the entire agreement process, from ID verification and authentication to electronic signature. This provides a complete record of the process, with strong identity assurance to ensure regulatory compliance.

When using the ID verification option in

OneSpan Sign

By using the ID verification option in OneSpan Sign, financial institutions and other organizations also build trust and provide a better customer experience, without the need for in-person office visits or manual identity verification processes.

You can learn how easy it is to validate identity using the “ID verification” functionality in OneSpan Sign also through this video.

Video: How to validate signer’s identity using “Signer’s Identity ID Verification” in OneSpan Sign