Claims and customer experience.

The digital context has allowed that part of the process in which the appraiser intervenes to be carried out by the client himself. Now all the policyholder has to do is pick up their smartphone, take some pictures of the damage, attach them to a digital form y send the notice by e-mail. Taking this one step further, technology has also allowed some insurance companies to capture images and video using drones and satellites to improve and accelerate the claims process and overall customer experienceespecially when processing a high volume of claims, which may arise, for example, from natural disasters.

In other words, digitization has made the first step in filing an insurance claim simple, convenient and straightforward. Herein lies the problem. “If the first step is that easy,” consumers say, “why isn’t the whole process?”

Customer expectations have changed

Realistically, digitalization has transformed consumer behaviors, expectations and experiences.

Thanks to the ease and simplicity that all things digital have brought to consumers’ lives, customers have a higher expectation of what interaction with an organization should be like.

And it doesn’t matter what industry that organization is in: retail, service, fast food, package delivery, a fresh cup of coffee, etc. Consumers expect their experience to be excellent, no matter what or who they are dealing with. With insurance, the expectation is no different, and it is changing rapidly.

Don’t pay attention to the Customer Experience and you will drive customers away.

So what happens when the Customer Experience provided does not live up to the consumer’s expectations?

A study by Forrester Research confirmed that the impact can be extremely negative. Review the chart below to see what customers have to say after they are upset, disappointed or frustrated with their insurance company:

| I feel annoyed | Only 23% of annoyed customers say they would buy a product from the same insurance company again. |

| I am disappointed | Fewer than 1 in 5 of the disappointed customers would advocate for their insurance company. |

| I feel frustrated | Only 12% of frustrated customers would consider staying with their insurance company. |

Now compare the above information with the table below, which shows when consumers have a positive customer experience with their insurer:

| I feel appreciated | 90% of customers who feel appreciated consider increasing their spending with their insurance company. |

| I feel respected | 92% of customers who feel respected would advocate for their insurance company. This is one of the highest percentages of any industry. |

| I feel valued | 66% of customers who feel valued by their insurance company consider staying with it. |

It’s good for businesses to strive to meet the experience expectations of today’s digital customer or consumer. In fact, preventing customers from switching to another insurer is an important way to increase revenue. Studies by Forrester Research have shown that if an insurer can improve the customer experience satisfaction rate by just 1%, this can translate into millions of dollars in additional revenue.

The claims process is a time for insurance companies to highlight

Insurance is one of those things that consumers and businesses buy and then don’t think much about until they need to make a claim. That’s why the claims experience is the “Moment of Truth” for many customers.

Insurance company employees, especially those who handle claims, also see it this way.

According to Forrester Research, staff in the insurance industry they spoke with see the claims process as, “when we can really showcase our capabilities, we have to be there for our policyholders, that’s when we can putourselves to the test.”

A good example of this took place in the USA. in 2017. In total, natural disasters affected 8% of the country’s population, making it one of the years with the highest number of disasters and with a very high cost.

One million vehicles were damaged or destroyed by Hurricanes Harvey and Irmay, and losses from Harvey alone were estimated at up to $4.9 billion. Wildfires in Northern California destroyed 14,000 homes, causing more than $3 billion in losses.

Due to the large number of claims that needed to be handled in 2017 and the amount of time it would take to process them, Forrester Research expected to see a decline in customer experience satisfaction. It turned out not to be the case.

In a Forrester survey the following year, customer satisfaction increased by 1%. Why did this happen? Forrester says it was because insurance companies went the extra mile to communicate with their customers during those difficult times, keeping them informed throughout the claims process. Some insurers even sent text messages to their customers to ensure they were safe after the storms. This high level of Customer Experience made their customers feel appreciated, respected and valued.

So why do insurers struggle with Customer Experience?

Most insurers are doing a good job of meeting customer experience expectations at the First Notice of Loss (FNOL) stage by providing their customers with convenient ways to file a claim.

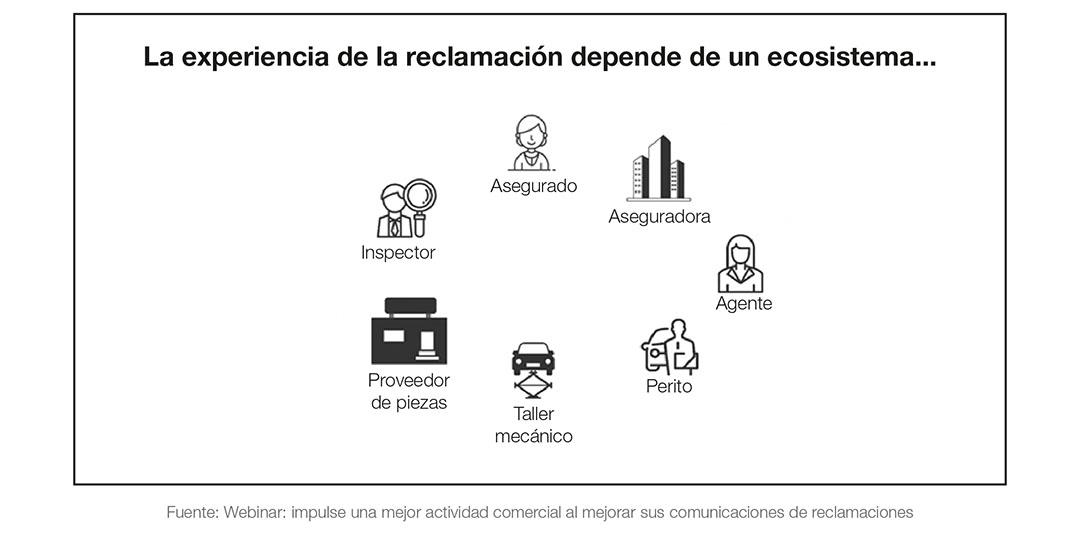

The problem is that after the first “Notification of Loss” stage, the claim experience depends on a vast ecosystem of different stakeholders. For example, an automatic claim would involve the insured, the carrier, the agent, the surveyor, the workshop, the parts supplier and the inspector.

The problem is not that the ecosystem is complex, but rather that the intervening parties are disconnected from each other. There is no way for all these intervening parties to communicate with each other and, as a result, the customer cannot get an accurate or timely response as to where his or her claim is in the process. Naturally, this leaves the consumer uninformed, annoyed, disappointed and frustrated because you don’t know what is happening with your claim.

The good news is that insurers are investing in technology that allows them to gain visibility into the Customer Journey.by connecting stakeholders inside and outside your organization, bringing about a change in claims response for communicate proactively with your customers. For example, some insurers are looking for ways of proactively monitor if customers are near an affected area or will be affected by a natural disaster, by contacting them in advance and providing a different type of service before the claim is submitted. We also see that insurers offering smart home devices or use the telematics to communicate with customers proactively when the sensor provides information indicating the need for attention before damage occurs.

Improve customer engagement

How can insurers reduce claims experience failures? One way is beginning to digitally communicate and provide status, as well as leveraging cloud technology to lessen the burden on IT to customize and send communications within the claims cycle. Anyone who has ever had to make an insurance claim knows that even when it is a small claim it is a hassle.

Resolving a claim quickly and accurately is as important to the insurer as it is to the customer. And while insurers still need to work through the complex ecosystem of stakeholders inside and outside their organization, the way they collaborate and streamline processes can change. For example, using a cloud solution would allow smaller insurers to reduce their dependence on their (already limited) IT resources, and improve the speed at which they can finalize claims communications: from shortening the end-to-end time to create and approve communications, to sending and receiving information digitally to the claimant. This also empowers employees, especially those on the front line of claims, who can personalize content and provide a better customer experience.

Today’s digital consumer wants to be more in control and understand what is happening when they make an insurance claim. Learn how to empower them and they will quickly increase their income. Watch the webinar.

“How to improve your business performance by improving your claims communications.”

.

Content extracted from

Quadient

.