For this reason, we are making available to you a whitepaper that will help financial institutions address the transformation of account opening processes. In this guide on technologies and trends to achieve fully digital experiences in this process, you can learn more about aspects such as identity verification or fraud detection.

As the whitepaper indicates, the abandonment rate in these processes is very high, between 65% and 95%. If a prospective customer does not have a positive experience with the bank or financial institution, he or she is likely to go to another provider without giving the first one another chance. This problem affects many banks that offer digital account opening, but require the customer to go to a branch to carry out processes such as identity verification. In fact, this last process is one of the great challenges of banking in terms of digital customer experience.

Today, two key trends can be highlighted when it comes to digital account opening. First of all, customers, especially millennials, have

millennials

consider security as a key priority when conducting online financial transactions. Hence, we can ensure that not all the frictions of the account opening process are negative, as the user is generally willing to invest a little more time when his extra action is aimed at protecting his account.

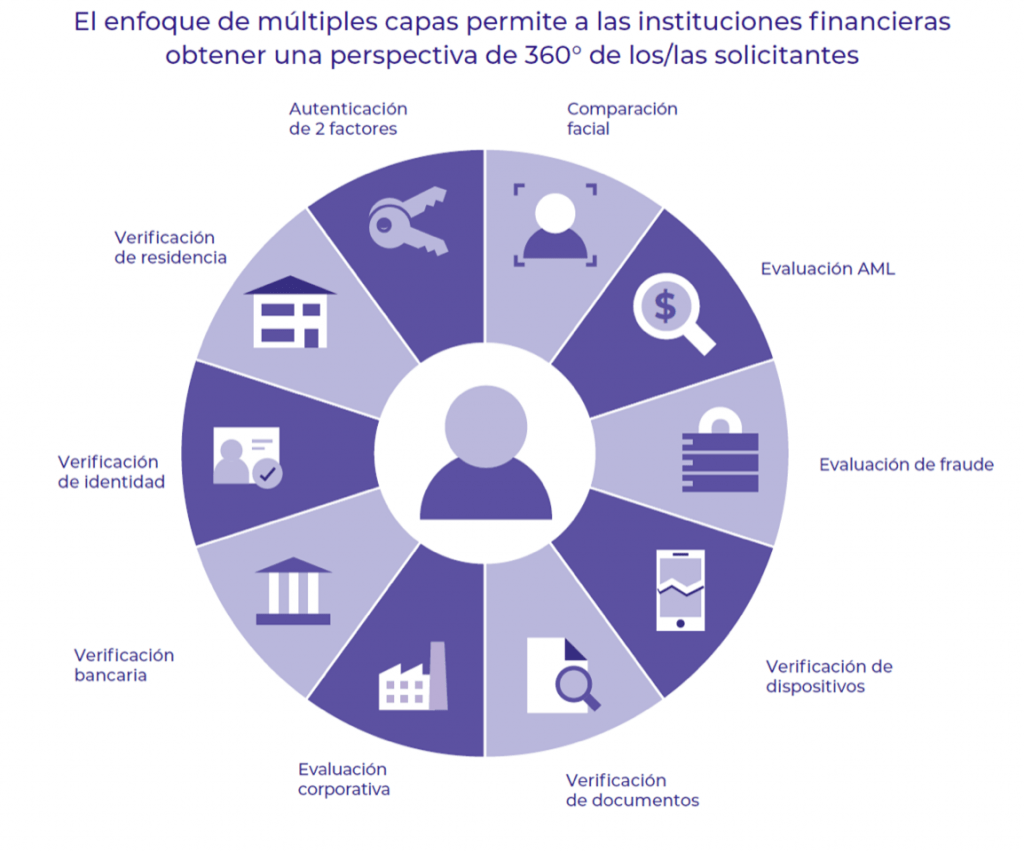

Second, a multi-layered digital identity approach offers great advantages to financial institutions, as it is scalable, flexible, auditable and enforceable, as well as configurable. This will provide the bank with a single platform that will enable it to access a wide range of identity and verification services offered by third parties for the following purposes use the method that best suits you for each channel and each type of customersuch as the facial comparison or the document verification. The latter is able to check whether the customer’s identity document is legitimate through advanced artificial intelligence and authenticity algorithms. This method facilitates other tasks such as manual data entry, as the technology extracts data such as name or date of birth. In the case of facial matching, the technology biometrically compares the ID document with a selfie that the applicant can take from his or her handheld device.

Source: OneSpan

The next step for financial institutions, once verification of the applicant’s identity has been obtained, is to offer their customers the possibility of electronically signing their documents. Implementing this technology makes the account opening process a more agile experience for the customer. It is important for the e-signature provider to offer a service available for multiple channels to enhance the bank’s omnichannel strategy, which will result in lower costs and errors.

Below, you can download a whitepaper to learn more about trends and tips for implementing a fully digital account opening experience. In addition, you will find key security and compliance considerations to prevent fraud during account opening, as well as fraudulent appropriation of the account after the account opening process.

Download the whitepaper to learn more about how to digitize account opening processes and avoid fraud.

Content extracted from

Onespan

.