In the banking sector, the management of legal communications is a process that is as relevant as it is sensitive. For this reason, security, traceability and compliance must be ensured.

Fortunately, nowadays banks can automate their legal communications with an online postal burofax to optimize time, reduce costs and ensure the legal validity of their notifications.

In other words, the online bureaufax in banks improves the efficiency of communication with customers and regulatory bodies, as well as providing other benefits that we will tell you about in this article.

Here is a summary of what you will discover:

- Challenges in banks’ legal communications. High volume of notifications, high costs, regulatory compliance and traceability.

- Action of the online postal bureaufax in the face of these challenges. Contribution of this solution to the aforementioned challenges.

- Advantages of automating banking communications with this online service. Operational optimization and risk reduction, among others.

- Implementation of the online burofax in banking. Integration into existing systems and adoption process.

Current challenges in banks’ legal communications

Banking institutions operate under a high volume of sensitive communications, so they face the following challenges.

Massive volume of legal notices

Banks handle thousands of notifications per month, from claims to claims, to judicial notifications. Coordinating these shipments manually or using traditional methods involves considerable effort and possible delivery errors.

High physical communications costs

The use of certified mail generates high costs in printing, logistics and document management. In addition, mailing and receiving times can delay key processes, affecting the bank’s operations.

Regulatory compliance and banking regulation

Banks must comply with strict regulations in the management of their legal communications. Any error in delivery or lack of reliable evidence may result in penalties or litigation.

Traceability and evidence in sensitive communications

In banking, it is essential to have detailed records that prove the date of sending, receipt and content of each communication, as is achieved when sending a burofax to a company or individual.

→ Find out how to send a burofax to a company.

But how can the online bureaufax solve all these challenges? We tell you about it below.

How online bureaufax solves legal challenges in banking

The digitized postal communications with legal value, such as the online postal bureaufax, offer an effective solution to all the challenges mentioned above.

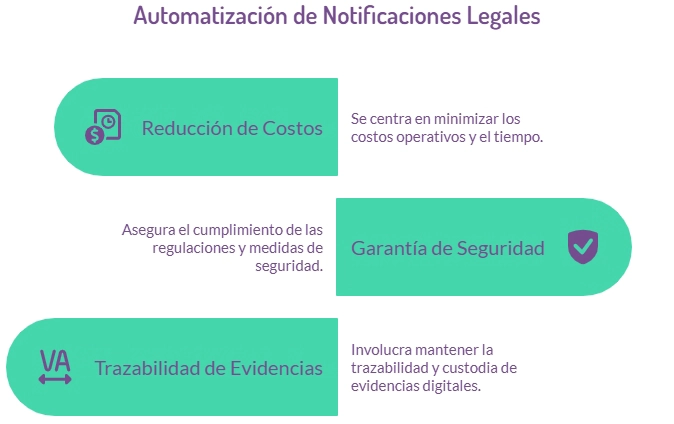

Automation of mass mailings of legal notices.

The different platforms allow you to manage the sending of an online bureaufax. sending an online burofax, ensuring that each notification is delivered quickly and with the necessary guarantees.

Reduction of costs and operating times

When the PostaMail service is used for banks to automate their legal communications to customers, it is the provider, in this case MailComms Group, who is responsible for processing, printing and enveloping at their facilities .

Assurance of safety and regulatory compliance

MailComms Group’s online bureaufax solutions for banks comply with the highest security and privacy measures certified to ISO 27001 and 27701, as well as national and international regulations, guaranteeing integrity, authenticity and confidentiality in every communication.

Traceability and custody of evidence in the digital environment

Each shipment is recorded with acknowledgement of receipt and digital certification of delivery, facilitating access to evidence in case of audits or legal requirements.

Benefits of online postal bureaufax automation for banks

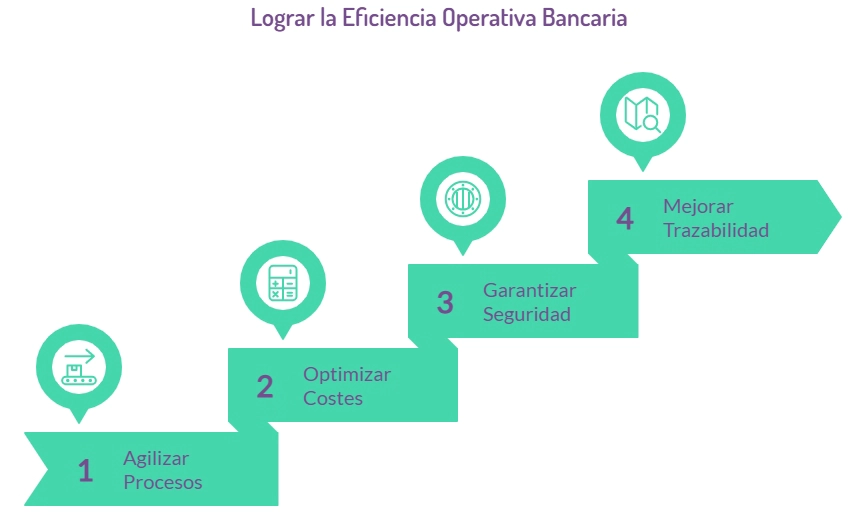

By automating legal communications with this solution, banks can:

- Streamline your internal processes and reduce administrative time. For example, if necessary, after a digital account digital account opening, validation and notification of documents could be ensured quickly and securely.

- Optimize operating costs, eliminating physical shipments managed outside the office.

- To guarantee the security and legal validity of your notifications.

- Improve traceability and access to certified evidence.

We have seen how service helps in the automation of legal communications in banking. But how can banks achieve this automation? Simply follow the steps outlined below.

Implementation of an online bureaufax solution in the banking sector

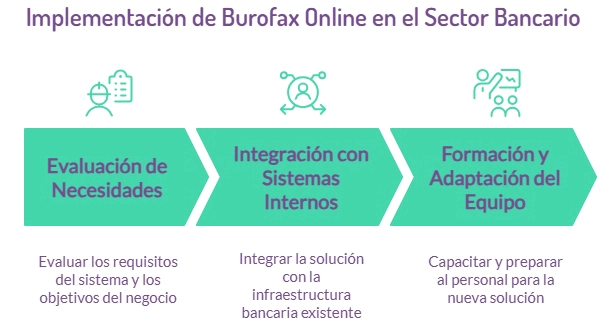

The integration of an online postal bureaufax system in a bank requires strategic planning, but its adoption is easy thanks to solutions such as PostaMail or CertySign. The process typically includes these basic steps:

- Needs assessment. The main thing is the analysis of communication volumes and legal requirements.

- Integration with internal systems. Connection with CRM and bank management tools.

- Training and adaptation of the team. Essential to ensure efficient use of the solution.

Do you want to bet on a quality service for the automation of legal notifications in banking? MailComms Group has the answer.

Solve your doubts and start optimizing the management of legal communications!

Frequently Asked Questions

How is the online bureaufax integrated into a bank's systems?

Online bureaufax solutions for automating legal communications in banks can be connected to bank management systems via APIs, facilitating the automation of mailings and registrations.

What do I need to start using the online postal bureaufax in a bank?

All you need is a specialized provider, such as Mailcomms Group, to ensure the security and compliance of digital communications.

How long does it take to implement the online bureaufax in a bank?

The implementation process can be completed in a few weeks, depending on the level of integration required with the bank’s internal systems.