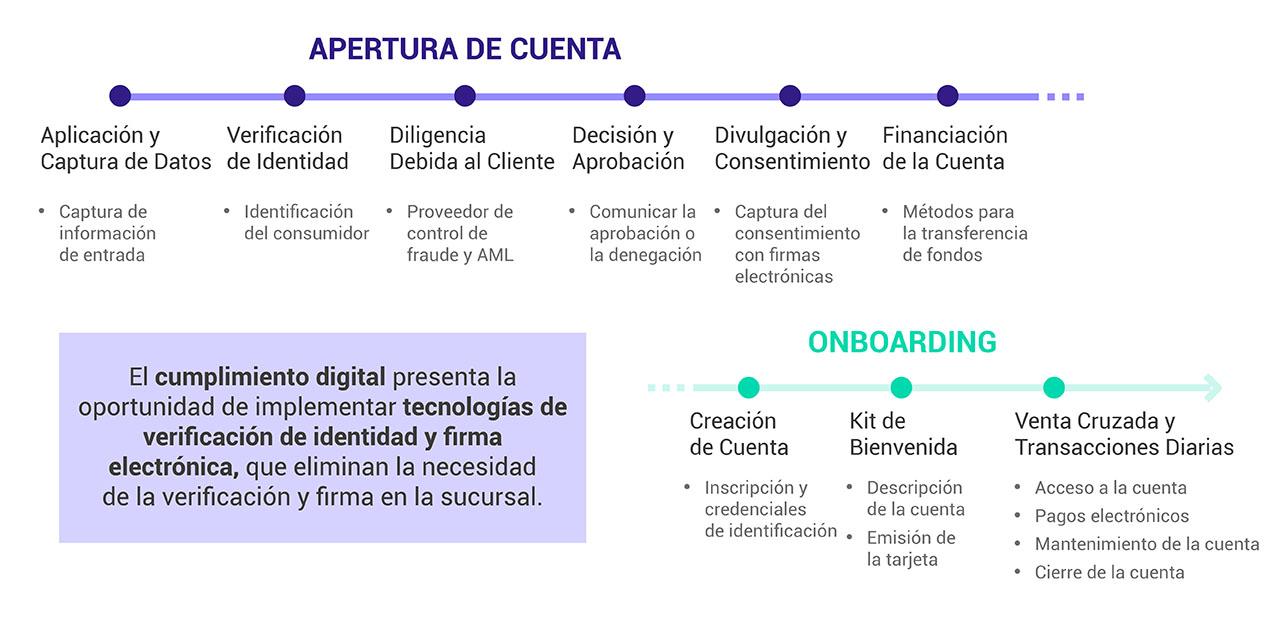

The challenge is that the digital account opening and onboarding customer journey involves a number of different steps that require attention (Figure 1). In remote, in-between channels where the applicant is not face-to-face with a bank employee, creating a direct digital experience can further complicate an already complex process.

Figure 1. The digital account opening and onboarding customer journey

in the financial services industry

Despite the push for end-to-end digitization of digital account opening and onboarding processes, banks and other financial institutions are still working with legacy systems and applications, which present a barrier to accelerating their digital projects. The result is a lengthy semi-digital process that is often difficult to overcome. According to analyst Tiffani Montez of the Aite Group, “application abandonment rates are still between 65% and 95%, depending on the product.” This means that most applicants either abandon the process and switch to another channel (e.g., branch office, call center) or find another financial institution that allows them to complete the application process in a single session.

The good news is that new and innovative approaches to digital compliance with identity verification and

identity verification and e-signature technologies offer an opportunity to

offer an opportunity to eliminate the need for in-branch verification and signature.

Challenges and opportunities for the customer journey of digital account opening and onboarding

Transforming the customer journey was not as easy as we thought.

The account opening and onboarding process in retail banking represents a critical first impression for both applicants and customers. This, coupled with the fact that consumers are increasingly migrating to online and mobile channels, is driving banks to modernize their existing account opening applications.

While banks are addressing the need for an end-to-end digital account opening process, the biggest problem is that most digital application experiences developed today do not use a digital and mobile approach. Instead, they simply take their branches and offline forms to web and mobile and let their risk and compliance groups drive the process. This often results in an overly long application process.

The current approach to identity verification leads to the abandonment of the process.

The financial services industry invests enormous amounts of money each year to attract and acquire new customers. Unfortunately, much of the Euros spent to get applicants to respond to marketing offers falls by the wayside once the applicant encounters a barrier during the account opening process. This sticking point is often the initial identity verification step. In this case, the financial institution must conduct Know Your Customer (KYC) checks to ensure that the applicant is who he/she claims to be and that he/she is not attempting to sign a

financial agreement

agreement illegally or fraudulently.

Today, identity verification approaches in the financial services industry fall into two main camps:

1. In-person verification

Many financial institutions force online and mobile applicants to come into the branch to verify their identity and sign documents. This means that applicants cannot complete the process in one sitting. As you can imagine, the introduction of this type of friction – which forces you to switch channels – increases the risk of abandonment, as it creates a gap in the digital customer journey.

If you are a financial institution that allows applicants to initiate the process online or on a mobile device, but still requires in-person and/or signature-based identity verification, ask yourself: was this process built to benefit your institution or the customer?

2.Knowledge-based Authentication ( KBA)

Some financial institutions have implemented online verification methods to meet KYC requirements for their digital channels. The most common method is the use of knowledge-based authentication or KBA, which includes credit bureau queries and identity data verification against third-party databases. Unfortunately, KBA is seen as a high-friction process that requires applicants to remember and answer personal questions based on public data. According to Gartner analyst Avivah Litan, “most KBA failures are experienced by legitimate users who are unable to answer questions because they can’t remember the answers, or because public records are missing or incorrect.”

In addition, KBA has become less reliable due to the large-scale data breaches that have occurred in recent years. Fraudsters are now better equipped than ever to successfully answer KBA questions based on data from data breaches, as well as information posted on social media or obtained from phishing.

Real-time government identity verification

New, modern approaches to digital identity verification offer a robust alternative to traditional, in-person verification methods, allowing organizations to maintain 100% digital workflow and, as a result, reduce churn.

The use of mobile identity document capture and verification is gaining momentum, and is increasingly supported by laws and regulations such as the

MOBILE Act

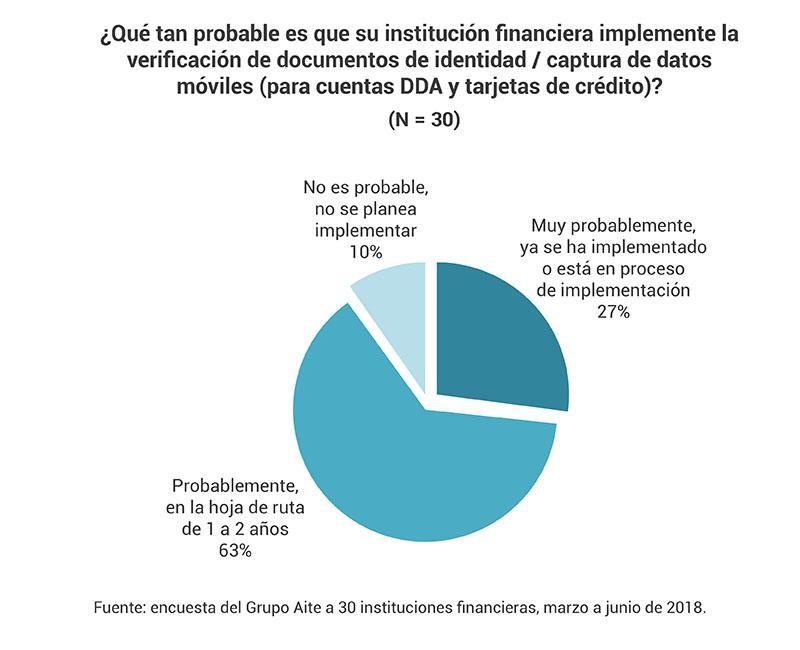

in the United States. This technology not only allows banks and other financial institutions to validate the authenticity of a document, but also allows them to obtain information from the ID document (e.g. name, date of birth, address, etc.) and populate the data directly into the digital application. According to Aite Group, 90% of the 30 financial institutions surveyed indicated that they would likely implement identity document verification/mobile data capture for their demand deposit and credit card account opening processes within one to two years.

Automating this process by using cloud-based services to scan the ID document and look for identifiers of a fraudulent document is now an accepted way to complete the verification process. In addition, machine learning continues to play an important role in achieving better and more accurate verification results in real time.

Redefining digital account opening and onboarding is within the scope.

Forcing a potential customer to switch channels (e.g., walk into a branch office) or using an outdated identity verification approach creates frustration that can lead to eventual abandonment and even negative word-of-mouth.

The good news is that there are modern and effective approaches to KYC available on the market today that not only prevent application fraud from occurring, but also do not add unnecessary friction to the customer journey. The last thing you want is to move to an all-digital process that results in the same abandonment rates you experienced with your traditional account opening processes.

Content extracted from

OneSpan

.

> Discover how reliable communications can transform the customer journey of financial customers during onboarding. We tell you: How banks can automate their legal communications using the online postal burofax.