Most interesting are the application areas in which banks and financial firms are going digital. These include customer service processes, account opening, and the onboarding customer relationships, which are of great importance in companies of all sizes.

“The trend toward full automation of customer processes is being driven by the financial services industry,” noted Mary Ellen Power, vice president of marketing at OneSpan, in an article

in an IT World Canada article

. “Anyone who values onboarding and opening an account digitally in 2019 should rethink it and make it a priority.”

According to Forrester, “Banks such as Bank of America, Royal Bank of Canada and US Bank are now digitally verifying a customer’s identity and using electronic signatures to facilitate an instant decision on certain retail products in a matter of minutes. In addition, they are issuing the account number in real time. This is the future of onboarding, so make sure you are on board.”

[2]

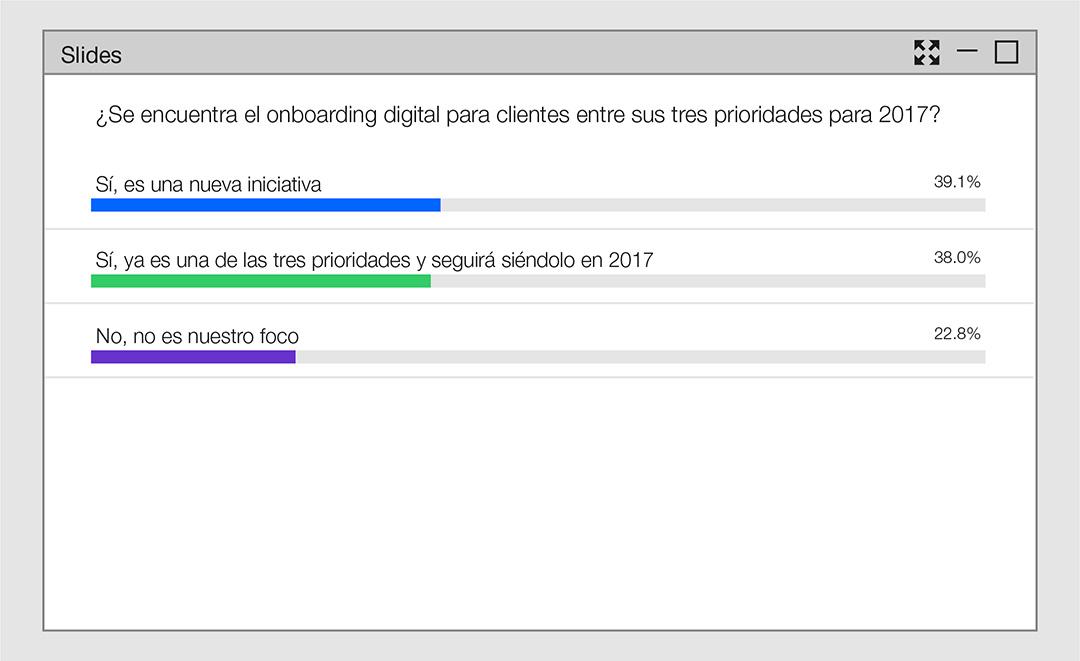

As further confirmation, in a webcast on digital account onboarding hosted by OneSpan and Avoka, 200 attendees were asked if digital customer onboarding was one of their top 3 priorities. Almost 80% said yes.

Why onboarding and opening digital accounts?

Improving the customer experience starts with a fully digital experience. Why?

- First, many high-value relationships derive from transactions such as opening an account. Institutions need to achieve excellence from the outset.

- Second, customers expect this: a KPMG report [3] shows that up to 90% of all millennials use mobile banking and take the digital experience for granted. In fact, both millennials and high net worth customers expect a mobile experience.

- Finally, and perhaps most importantly, digitization allows your staff to spend time engaging customers in the conversations necessary to promote and cross-sell high-value products and services. For example, a fully digital process facilitates the sale of products such as loan insurance, bringing in additional revenue.

The benefits

The most direct way through which financial service providers can improve onboarding and account opening is by ensuring that the process remains fully digital. It achieves greater speed, less manual work, fewer errors, more rigorous compliance and meets today’s expectations of such an experience.

- Workflow rules eliminate errors: all data and signatures are captured correctly the first time, during a single transaction session. Manual processes generate errors, such as missing signatures and empty data fields on paper forms. These Not-in-Good-Order documents are not in order or correct.

Not-in-Good-Order documents

(NIGO documents) are time-consuming and costly to correct, but financial companies have no choice, they have to fix it. And fixing it is 3 to 4 times the cost of an error-free digital process, simply because of all the additional time and effort involved in recontacting the customer and working to fix any errors. - Electronic signatures speed up the process: the elimination of handwritten signatures compresses the process from days or weeks into a single session. This can be seen in the case of the Bank of Montreal, which recently introduced electronic signatures to speed up the incorporation process.

- Mobile First customers now have an alternative to paper: when people log in on a mobile device, the signing experience becomes easier and more convenient, more personal and more accessible than on desktops or laptops. Giving customers the ability to e-sign with their smartphone removes barriers and gives them the freedom to choose how they transact with their financial institution.

Sources:

[1] Vendor Landscape: E-Signature, Q4 2016, Forrester Research

[2] Vendor Landscape: Financial Services Client On-Boarding Solutions, Forrester Research

[3] Consumer Loss Barometer Report, KPMG, August 2016.

Content extracted from

OneSpan Sign

.