Identity fraud enforcement and prevention: a question of balance.

Cases of application and identity fraud are highly damaging to financial institutions and are being fueled, in part, by the more than

13 trillion data records that have been lost or stolen since 2013.

. After first-party fraud (when someone or a group of people intentionally misrepresent their identity or give false information), stolen data obtained through data breaches are one of the

three leading causes of application fraud.

.

To prevent application fraud, financial institutions must successfully identify fraudulent activity or fraudulent identity documents in real time at the beginning of the new account opening process. At the same time, FIs are also under pressure to digitize account openings so that customers can open an account completely online or via a mobile device. Recent research shows the extent of these pressures, especially among younger demographics (

37% of consumers and 57% of millennials say they would prefer to open a new account online

).

To be successful in their fraud prevention strategy, banks must strike a balance between security and customer experience. Banks should establish an account opening process that includes real-time risk assessment and identity verification, while providing a digital customer experience. The importance of improving the customer experience cannot be underestimated. 88% of FIs say that

improving the onboarding experience for customers is very important, as they make investments in technology.

.

With the right solution, banks can have the best of both worlds. To show how OneSpan’s firm, which offers MailTecK & Customer Comms, addresses this balance, let’s walk through a typical digital account opening experience.

Open a new bank account online or via mobile device

As we move through this digital account opening process , we have included screenshots of the relevant desktop and mobile interfaces to demonstrate the customer experience. In addition, we will also describe what the solution is doing behind the scenes to help prevent application fraud. Although this post presents a mobile scenario, a browser-based banking application with account opening capabilities can also provide the same seamless experience.

First, we need our customer. Suppose a potential customer, Holly, is switching to a new bank and wants to open a new savings account on the bank’s website via her cell phone. Your first step is to log on to the bank’s website and select “Open an account” to begin the process.

Digital identity verification prevents identity fraud

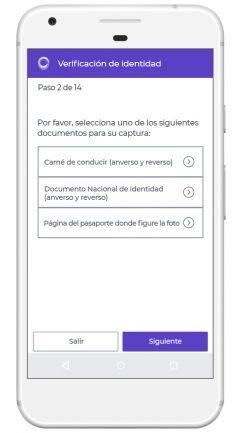

Since Holly is opening her new account remotely (not at a bank or branch), she is asked to verify her identity digitally by scanning both the front and back of her driver’s license or ID card with the camera on her mobile device.

This is the point where application

most likely for application fraud to occur.

. Detecting it at the beginning of the new account application stage by identifying fraudulent identity documents greatly reduces the chances of having to mitigate fraud later on.

Once the driver’s license images are captured, OneSpan uses artificial intelligence and advanced authenticity algorithms to analyze Holly’s driver’s license image. This produces an authenticity score to determine whether Holly’s driver’s license is fake or authentic.

The solution can then include additional authentication controls, such as

facial biometrics

or fingerprint biometrics, to further verify the applicant’s identity.

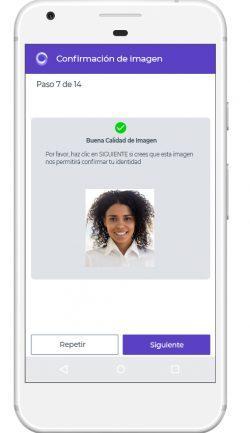

In this scenario, Holly is asked to further verify her identity through facial comparison.

facial comparison

. It is very easy, as the customer only has to take a selfie.

Behind the Screen Solution

Secure Agreement Automation OneSpan

solution extracts Holly’s biometric data from her selfie and compares it to the authenticated driver’s license image to determine if she is physically present and who she claims to be.

Real presence detection can also be applied to Holly’s selfie to demonstrate real human presence. Real presence detection helps to prove that an image has not been created fraudulently using methods such as high-resolution prints or prerecorded videos.

These digital identity verification methods allow us to know if Holly’s identity documents are authentic and that Holly is who she claims to be. These steps help mitigate application fraud.

The next step in the process of opening a new account is for Holly to review, sign and execute the terms of the account agreement.

Electronic signature used to create an enforceable digital agreement

Once Holly’s identity has been digitally validated, the bank submits the pre-contract information and the completed application for electronic review and signature.

Because OneSpan Secure Agreement Automation seamlessly combines identity verification and electronic signature capabilities, it captures Holly’s personal data from her driver’s license and automatically imports it into the application form.

At this point OneSpan allows Holly to review and electronically sign her account agreement.

Once the contract has been reviewed by Holly, she simply “taps to sign” and submits her completed application.

Behind the screen OneSpan creates an electronic audit trail of the entire account opening process, capturing every screen Holly sees and every action she takes. The audit trail ensures that the financial institution has a detailed record of the digital process, including digital identity verification and electronic signature steps.

Relying on Holly’s mobile device

Now that the application is signed and executed, Holly’s smartphone is registered so that OneSpan and the bank can recognize it as a trusted device. This means that Holly will be seamlessly authenticated when using the bank’s mobile app for her daily banking activities.

To do this Holly creates a secure 6-digit PIN number and sends it to the bank. Once your mobile device is identified by the bank, it is now trusted and automatically synchronizes with your new savings account.

Holly’s application was now successfully completed. It took him only a few minutes to open his new account.

With Holly’s new account open, she is free to add funds and continue with the standard onboarding process offered by her financial institution. During the lead to new client process Holly was able to complete the account opening process completely remotely and through digital channels. This provides the maximum possible comfort and flexibility.

Reducing identity and application fraud

Financial institutions need to reduce instances of application fraud. Digital identity verification can enable them to mitigate application fraud while providing a more positive customer experience. With automatic identity document verification and facial matching, banks can validate customer identity in real time, whether the transaction is conducted online or via a mobile device, as demonstrated in this real-life scenario we have presented.

Digital identity verification not only helps FIs prevent application fraud, but can also help financial institutions meet their know-your-customer compliance requirements (Know Your Customer or KYC) and against money laundering (anti-money laundering or AML).

Secure automation of agreements through digital identity verification, electronic signature and digital audit trails also enables banks and financial institutions to create legally enforceable and compliant agreements. With a complete digital audit trail, banks and financial institutions can demonstrate to external or internal auditors that they followed a consistent and compliant process when onboarding a new customer.

Content extracted from OneSpan.