Table of Contents

Ensuring the correct management and tracking of legal documentation is a priority for many companies. Specifically, improving the traceability of legal documents in insurance companies allows minimizing risks, guaranteeing regulatory compliance and optimizing response times in claims and administrative tasks.

In this context, the bureaufax in the insurance sector plays an important role in the world of certified communications, although it is not the only efficient solution. We tell you all the details.

Here’s what you’ll find out:

- Relevance of document traceability in insurance companies. Avoids document loss and improves legal management.

- Common problems in the traceability of legal documents. Lost files, missing records and communication delays.

- What to do to optimize document traceability. Digitalization, electronic signatures and certified platforms.

- Benefits of improving traceability of legal documents in insurance companies. Reduced litigation, regulatory compliance and increased transparency.

We also invite you to read this related article on the legal validity of insurance companies’ communications with clients and third parties.

The importance of document traceability in the insurance sector

Legal documentation is present in the insurance industry at different points in the relationship with the insured: policies, contracts, claims and communications with clients and regulatory bodies. In all cases, traceability ensures that these documents can be located at all times, with a record of modifications and access.

Failure to do so could lead to serious problems, such as the ones we highlight below. Read on if you want to learn about them.

✅ Optimize the management of policies and contracts with electronic electronic signature in the insurance sector. Here’s how.

Main challenges in the traceability of legal documents

Despite progressive digitization, many insurers still have difficulties in their document management.

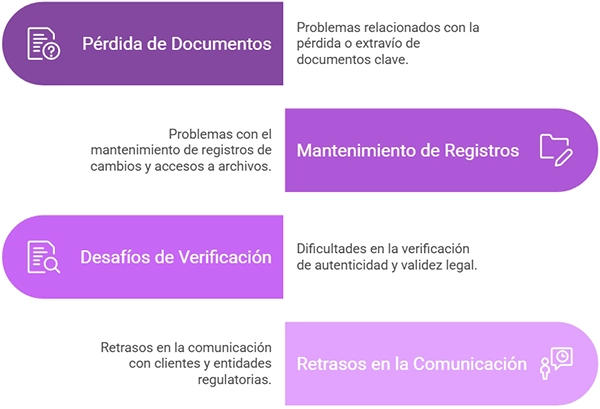

- Loss or misplacement of key documents.

. . insurance contracts and legal communications must be available and protected. Without an efficient traceability system, an insurer can lose essential documents. - Lack of records of changes and access to files.

Not having a detailed history of modifications and access to documents can generate vulnerabilities in audits and legal problems. Example: a client could challenge a clause and the insurer would have no way to prove its validity over time. - Difficulties in verifying authenticity and legal validity.

In a highly regulated industry such as insurance, guaranteeing the authenticity of documents is essential. The lack of digital certification mechanisms can open the door to fraud or contract challenges. - Delays in communication with customers and regulatory entities.

Failure to extend response time in administrative processes and claims is crucial to the customer experience. A document that takes too long to reach its destination can mean financial losses and legal problems for the insurer.

Here’s how to optimize document traceability in the insurance industry with efficient tools and strategies.

How to optimize traceability of legal documents in insurance companies

To solve these challenges, insurers can adopt various strategies focused on digitization and document security.

Digitalization and automation of document processes

The digitization and automation of document processes enables insurers to manage large volumes of information efficiently and securely. For example, the use of online postal bureaufax , or electronic bureaufax streamlines the mass mailing of legally valid postal notifications, eliminating manual errors and ensuring an accurate record of each communication.

Use of digital signatures and electronic certificates

Digital signatures guarantee the authenticity and legal validity of documents, avoiding the need for manual processes and reducing the risk of forgery. For example, in an automobile insurance company, the use of electronic certificates speeds up the approval of claims and avoids fraud.

✅ The digital signature of contracts simplifies the validation process and improves security. Discover its benefits.

Implementation of certified communication platforms

Certified communication platforms such as CertySign y PostalMail allow insurers to send legal documents with full legal validity through online and offline (postal) channels. These solutions ensure that contracts, claims and notifications arrive securely at their destination, with full traceability of the process.

Benefits of efficient document traceability in the insurance sector

Optimizing the traceability of legal documents provides key advantages for the management of any insurance company.

- Reduced risk of litigation and contractual disputes.

Having a clear and verifiable record of all documents minimizes the risk of legal claims and facilitates defense in case of disputes. - Regulatory compliance with clear and auditable records.

Insurers must comply with strict regulations. Having traceable and certified documentation simplifies audits and reduces penalties. - Greater trust and transparency with clients and regulators.

When an insurer manages its documentation in a transparent manner, it generates trust in both its clients and supervisory bodies. - Time reduction in administrative and claims processes.

Automating document management speeds up procedures, reducing response times in claims and optimizing customer relations.

If your insurance company is looking to improve the traceability of its legal documents, MailComms Group’ s services can help. Through communications such as certified email, certified SMS, certified WhatsApp or digitally sent burofax, among others, you can guarantee the registration, tracking and secure receipt of legal documents.

Want to know more? Contact us now for more information.

Frequently Asked Questions

How does document traceability ensure the security of insurance contracts?

Digital records, digital identification, electronic signatures and certified communications ensure the integrity of contracts and prevent the loss or alteration of key documents.

What technological tools are most effective for improving document traceability in insurance companies?

Some of the most commonly used are certified e-mail, electronic signature, and bureaufax sent through a digital platform.

Tools such as certified identification, which reduce the risk of identity theft and speed up the online contracting process, are becoming increasingly important, provided they come from a qualified and trustworthy service provider such as MailComms Group.

How can an insurer reduce errors in legal documentation?

Automating processes, digitizing files and using certified platforms for information exchange, such as PostaMail or CertySign.