Table of Contents

- The importance of digitization in legal communications in the insurance industry

- How can digitalization optimize processes in insurance companies?

- Use cases of digitization of legal communications in insurance companies

- How to implement digitization of legal communications in an insurance company

- Frequently asked questions on the digitization of legal communications in the insurance industry

Insurance companies work with huge amounts of highly sensitive documentation with clear legal implications. Documents are exchanged between different parties on an ongoing basis. This framework demands that the authenticity of all your legal communications be guaranteed, but also that they be streamlined.

Solutions such as certified email or the online postal burofax for the digitalization of these communicative processes serve to underpin this verification, optimizing time and reducing possible failures.

This article analyzes the keys to this procedure:

- 3 main benefits of digitizing legal communications in an insurer: minimizes failures, saves time/cost and ensures regulatory compliance.

- Specific cases in which to apply the sending of certified electronic messages.

- Mechanism for implementing a certified communications system in an insurance company.

Do you have doubts about the guarantees of digital communications? This is how the online burofax guarantees privacy and security for your company.

The importance of digitization in legal communications in the insurance industry

The world of insurance companies moves an enormous amount of documents of all kinds. In addition, a large part of their activity involves the exchange of this information between third parties, between different departments of the company itself and with legal representatives.

In this context, it is understandable that one of the concerns of an insurance company is to speed up the transfer of information. But, of course, without losing guarantees. It is clear that the possibility of digitizing legal communications is the perfect solution, because it meets both criteria, immediacy and legal validity.

How can digitalization optimize processes in insurance companies?

Avoiding disputes and simplifying exchanges of documentation between parties are two key issues for an insurance company, as they are part of its day-to-day business. A faster and simpler mechanism needs to be implemented, without impacting the quality and accuracy of the information sent. This is achieved with digital tools such as the online bureaufax.

Online bureaufax vs. electronic bureaufax: Is it the same?

Reduced human error and improved traceability

The digitization of communications has a direct impact on reducing the risk of making mistakes. Logically, the simpler the procedures are and the less documents have to be handled, the less chance of making mistakes or losing a piece of paper.

In addition, the possibility of real-time tracking of the shipment helps to have a more precise control of the process. Even if a rectification is necessary or we have made a mistake, we realize it earlier and we can send a new shipment, this one correct.

Saving time and costs in document management

The traditional mechanism used by insurers for their legal notices was the registered mail. It is a longer procedure, which implies having to physically move and with the risk of misplacing the documents. To this must be added the cost of the paperwork and the dedication of personnel for these tasks.

With digital communications all these difficulties are solved. Shipments are immediate, secure, simpler and at a lower cost. All this, without undermining its legal validity. Depending on the level of legal validity required, you can choose one type of registered mail or another.

You don’t know the difference difference between online postal burofax or certified email?Don’t miss this article!

Regulatory compliance and legal risk reduction

Reliable electronic notifications must comply with the regulations governing digital communications. In this sense, it is advisable to work with qualified providers to contract these communications services, because they are the ones that have been accredited to comply with the eIDAS 2 Regulation and the RGPD, both of European scope.

And thinking about the full legal validity, it is necessary to emphasize the importance of the digital signature. It is, undoubtedly, a tool that reinforces the verification of those involved in an electronic communication.

Find out more in our article on the digital signature of contracts: how valid is it and what are its benefits?

Use cases of digitization of legal communications in insurance companies

Certified electronic messaging systems can be used for any communication that an insurer has to make. However, there are some cases in which it is a clearly advantageous option. Always maintaining confidentiality and data protection, which are essential requirements so that they do not lose their legal validity.

Certified communication in policy cancellations and renewals

It is a very effective way to legitimize cancellations and renewals to your customers. We must not forget that these situations must be communicated in an official way, it is not enough with a call or attention in the office if there is no delivery of documents.

Notification of non-payment and debt claims with legal backing

In the claim for non-payment, the insurer has to ensure receipt by the interested party. The acknowledgement of receipt mechanism, included in the online burofax, but which can also be incorporated in a certified email, is essential to cover this requirement.

Management of contractual changes and policy modification notices

Insurers can avoid multiple conflicts with their customers by using certified e-mails for all contract modification communications. The digital notification has legal validity and immediacy. In addition, with the acknowledgement of receipt, the recipient cannot claim ignorance.

How to implement digitization of legal communications in an insurance company

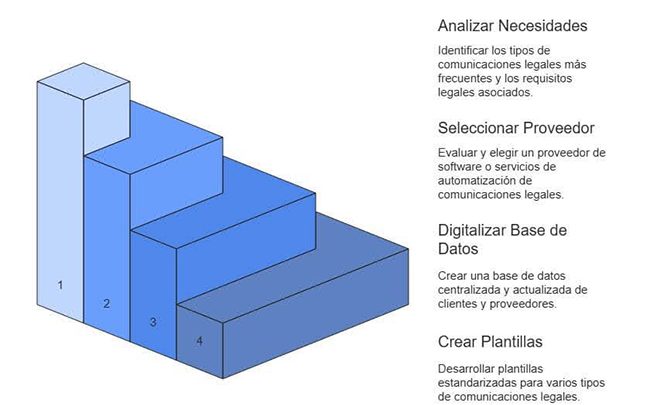

In the specific case of insurance companies, taking into account the volume of legal communications, our recommendation is to digitize those mailings. These are the steps to follow:

- Analyze your company’s specific legal communications needs.

- Look for a qualified service provider whose offer is the one that best suits your requirements.

- It is interesting to make a digitized database of your customers and suppliers. This way, access is even faster.

- Create standardized templates for different types of communications.

You have to know our PostaMail platform. It is a service specially designed to manage digital communications with legal validity. At MailComms Group we are always at the forefront of omnichannel communication.

Frequently asked questions on the digitization of legal communications in the insurance industry

What are the benefits of digitizing legal notices in insurance companies?

The main benefit is that an agile communication system is guaranteed, with legal validity and preserving the privacy of the content. In addition, the risk of human error is minimized. But, no less important are the advantages for the company in terms of time and cost savings.

How does the online burofax guarantee security and legal validity in the insurance sector?

The online bureaufax has an impact on two essential aspects that are required for a mail to be legally valid. On the one hand, it allows a detailed tracking of the traceability of the sending, including the acknowledgement of receipt. The other is that the unalterability of the document is verified.

What types of notifications can be digitized in an insurance company?

In principle, any notification that needs legal validity. Among the most common ones with which insurance companies work are: claims and claims, renewal, modifications and cancellation of policies, non-payments and debts.

Is the online burofax valid as evidence in legal disputes within the insurance sector?

Of course. In fact, the certified online bureaufax is a system for sending documents with full legal validity for all types of legal proceedings.

How is privacy and data protection ensured in digital legal notices?

There are several specialized tools that serve to ensure privacy and data protection in an electronic document delivery process: data encryption systems, use of a VPN to protect Internet connections, cybersecurity software, secure password managers and cloud backup with recovery protocols.