The insurance market is one of the most interested in digital transformation. A sector in which

We will go deeper into this topic by addressing two essential aspects:

- The concept of online postal bureaufax and its peculiarities.

- The advantages it brings to an insurance company’s documentary communications.

It is time to remember the differences between the postal online bureaufax and the electronic bureaufax.

What is the online postal bureaufax?

Fortunately, the digitization of business communications has evolved at a dizzying pace in recent years. This has led to the creation of different solutions, so that the company can choose the most appropriate one for each situation.

However, this diversification of solutions can lead to errors, because the differences are not clear and, therefore, which is the optimal one depending on each situation. So let’s start by remembering what is the online postal bureaufax. It is an interesting combination of online management and delivery of documents in traditional paper format, which works as follows:

- The customer sends the bureaufax comfortably from his computer.

- The information and documents are managed through our platforms, with total guarantee of security and data protection.

- We print, envelop in a secure environment and distribute through Correos because we are their Commercial Agent.

- As qualified trust service providers, we collect and safeguard certifiable evidence. In the case of the bureaufax they are: sender, delivery (PEE, Electronic Proof of Delivery), contents and identification of the receiver.

Find out when online postal burofax or other electronic notifications are right for your company.

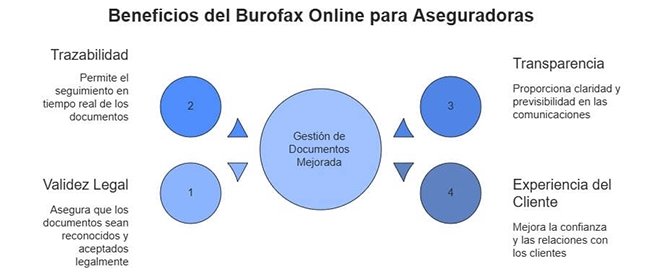

Advantages of the online postal bureaufax for document management in the insurance industry

The certification process is key to give legal validity to communications. In the case of an insurance company, in a highly regulated industry, it is imperative that all general and specific rules affecting its legal communications are complied with.

With the online postal burofax this aspect is guaranteed, but there are also other benefits for the insurance companies that use this method.

Full legal validity

Legal communications by online postal bureaufax have all the legal guarantees, as recognized in various judgments. That is, provided that the evidence collected and generated is produced in accordance with the provisions of Regulation (EU) 910/2014 eIDAS.

In addition, the law recognizes full validity to the evidences that present as certified events the sender, the delivery, the content and the identification of the receiver. This is fulfilled by the online postal bureaufax, which, in addition, is reinforced by the physical delivery of the document.

Here you can see how the online postal bureaufax guarantees privacy and security according to ISO standards.

Traceability of documents

The online postal bureaufax allows detailed, real-time tracking of all stages of the mailing process. Everything is traced and can be consulted at any time. There is no possibility of doubts or alteration of the documents.

This traceability occurs because each mailing made with an online postal bureaufax is registered in a digital platform, where the status of the document can be consulted in real time.

In addition, with the Proof of Electronic Delivery (PEE) you obtain an electronic certificate provided by the person responsible for the physical delivery of the document.

You may be interested to learn about these strategies to improve the traceability of insurance documents.

Transparency in communications

A failure or confusion in the delivery of a document can lead to a legal dispute. In a sector such as the insurance industry, where the raw material of work is the exchange of documents, the probability of suffering this type of incident is higher.

The online postal bureaufax avoids any ambiguity, as the entire process can be clearly tracked. Transparency translates into predictability: the intervening parties are more aware of their rights and obligations.

Improved customer experience

Qualities such as the transparency and traceability of the online postal bureaufax reduce to a minimum the space for conflicts or problems with customers or suppliers of an insurer.

This issue is important for your company, but it is also very positively valued by users. It generates a feeling of trust that usually ends up generating more lasting relationships.

At MailComms Group we offer you our virtual post office, PostaMail. It is the tool your insurance company needs to improve its document management.

Frequently asked questions on how online postal bureaufax improves document management in the insurance industry

Can the online postal bureaufax be used for the management of sensitive documents for insurers?

Precisely, the traceability of these shipments is one of the qualities that makes it the most suitable solution for managing the most sensitive documents. In addition to ensuring compliance with regulatory standards and data privacy and security, an essential factor in a highly regulated sector.

Does the online postal burofax serve as reliable proof in legal disputes with insurers?

Always, since it certifies the events required by law: issuer, delivery, contents and identification of the receiver. Without forgetting that there is a physical delivery of the document.

Can all insurers implement an online postal burofax system?

Yes, since the platform integrates with ERPs, CRMs or other corporate systems.

How does the online postal bureaufax guarantee the security and confidentiality of the documents sent?

The key is to choose a Qualified Trusted Service Provider. This implies that their authentication and certification protocols comply with current privacy and data protection regulations.

At MailComms Group, we also have two other accreditations, ISO 27001 (information security) and ISO 27701 (information privacy), which guarantee our full compliance with regulations and our commitment to security in the processing, management and control of data.