Table of Contents

- Benefits of certified email for insurers

- Practical applications of certified email in the insurance sector

- How to implement certified email in insurance companies

- Best practices to ensure the legal validity of communications

- Frequently asked questions about certified email for documents and claims in insurance companies

One of the areas that will benefit most from the incorporation of digitized communications is insurance companies. It is easy to understand if we consider that a large part of their activity involves a constant exchange of documents. But, it is even more evident if we look at the possibility of managing claims by means of a certified email.

Below, we review:

- The advantages of incorporating certified digital mailings in insurance companies: legality, security, and time/cost savings.

- Most interesting uses of certified email for an insurance company: policies, claims, legal and administrative notifications.

- Guidelines for implementing certified e-mails.

- Keys to ensure their legal validity: how they are drafted and sent, their conservation and the follow-up of notifications.

Thinking about automating communications in your company? We explain how to do it through certified e-mails.

Benefits of certified email for insurers

The insurance industry is a highly regulated sector where the rights of the insured are protected and special attention is paid by the regulatory entities. This translates into very measured processes, with specific times and communications that must be able to demonstrate that they have taken place in a timely manner.

Although they still have their place in certain procedures.

Conventional postal certifications have become obsolete compared to the advantages of opting for digital formats:

- Delivery guarantee and verified receipt

The certified email allows you to use the option of acknowledgement of receipt, which confirms its receipt and that it has been opened. A very simple step, just select this option before sending the message.Learn step by step how to send a certified email and ensure the security of your message.

- Security and protection of sensitive data

All the steps of sending certified electronic documents are carried out under maximum conditions of discretion. From the drafting and attachment of documents, since you choose the place and time when there are no people around, as well as the recipient of the message.In addition, the digital certification process has maximum security guarantees. Do not forget that there is an essential external mediator, the qualified provider, who attests to the unalterability of all data.

- Savings in time and operating costs

Email is practically immediate. The entire process can be carried out from start to finish without leaving the workstation. What’s more, one person handles the entire procedure. Obviously, nothing to do with the preparation of paper documents and the transfer to a post office.

In terms of economic costs, certified digital mail is much cheaper than its postal counterpart.

Here you can review in more detail the operational cost savings of digitizing your legal communications.

Practical applications of certified email in the insurance sector

- Sending policies and contracts

We have already pointed out the legal validity of these certified digital communications, hence they are used for the signing of insurance contracts or policies. Also, ofany modification or clause that is added or eliminated . And all the documentation is kept together, which facilitates its consultation.By incorporating the digital signature you reinforce the legal validity of contracts.

- Claims and claims management

Certified e-mails allow very precise tracking of each step in the process of a claim or claim. It prevents documents from being lost or misplaced, which can delay procedures and even lead to overruns.This traceability of communications results in greater legal security for an insurer in the event of challenges or disputes with its customers.

- Legal and administrative notifications

Expiry dates, renewals, even the confirmation of a claim. These are everyday procedures in an insurance company that are simplified by automating communications with certified digital mail.Discover why the certified bureaufax is an excellent way to automate a company’ s legal communications.

How to implement certified email in insurance companies

Whenever a company is going to acquire a new tool to manage any of its activities, it is advisable to make a prior analysis of the situation. What are the main processes, which people handle them or the main needs? These are some of the questions to be assessed in order to make the most efficient decision.

It is a step that, of course, serves to choose the most appropriate digital messaging service for a company. In the case of insurance companies, we recommend that you take these considerations into account:

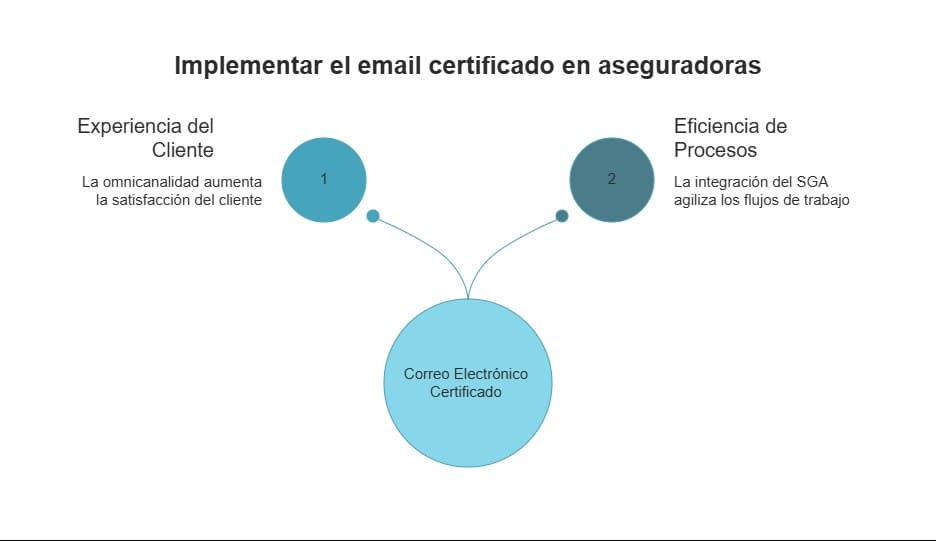

- The customer experience is enhanced if you provide them with an omnichannel digital communications system. In addition to email, you make other channels available to them (SMS, WhatsApp, web publications or bureaufax), all with certification.

- Its integration into insurance management systems (EMS), so that processes are streamlined and communications management can be automated.

Best practices to ensure the legal validity of communications

The key is the choice of a qualified provider of electronic communications services. This external interlocutor is the one that guarantees the authenticity of sending, reception and content.

Insist that these providers have passed an exhaustive analysis by the relevant authorities to verify that they comply with the regulations on security and privacy in digital communications. It is a hyper-regulated and constantly evolving field and these professional services are aware of any changes. And they are also essential for cybersecurity issues.

Once this first aspect has been ensured, insurance companies have their own responsibility to underpin the legal validity of the digital shipments they make. Above all, it is essential to pay attention to these three.

Content and format of certified emails

In any message or notification that wants to have evidentiary value, the forms can be as decisive as the contents. In most cases, replies and notifications in response to a claim or notification of the opening of a claim must include a series of essential data.

In the classic paper-based procedures, there were forms to be filled in. This reduced the possibility of errors or oversights, which could result in a transaction being challenged or invalidated.

Preservation and archiving of evidence

No one would think of scribbling on the pages of a contract or leaving a claim scattered across an office desk. The same approach should be applied to digital communications.

If they are to retain their full evidentiary validity, they must be retained and stored without subsequent modification or alteration. It is also important that each individual document can be located quickly when it is needed.

Follow-up and control of notifications

The most practical and efficient way to manage all the certified digital communications of an insurer is to take advantage of platforms that combine omnichannel online (SMS, WhatsApp, web, email …), and offline (Postal) shipments and allow traceability of omnichannel shipments as it has a tracking through the traceability of shipments.

In this way, the insurer can adapt to the specific preferences of each insured, Do you know our CertySign platform? A tool that we make available to your company to facilitate the management of your certified e-mails.

Certified email is an excellent formula for managing responses to claims received by an insurer. At MailComms Group we go even further. Contact us at and discover our complete certified notifications service.

Frequently asked questions about certified email for documents and claims in insurance companies

Is certified email legally valid for insurance claims?

Certified digital mails are reliable evidence that can be presented in any judicial dispute or mediation conflict.

How does certified email guarantee the security and confidentiality of documents?

It is the qualified trust service provider who acts as a “notary”, providing evidence that a given communication has taken place, and who guarantees the veracity of all the elements involved in that message are authentic and have not been altered.

What kind of documents can be sent through this solution in an insurance company?

In principle, any notification maintains full legal legal validity if it is sent by means of a certified email. However, insurance companies tend to use this medium preferably for the issuance of claims, policy issuance, expirations and renewals or notification of claims.

Is it possible to automate the sending of certified emails in insurance management?

Of course, systems such as Salesforce, through Agentforce or marketing Cloud allow certified email to be sent automatically in certain circumstances. This is made possible by the connection between the CertySign and Salesforce platforms.