Meet IDD with our omnichannel solutions

IDD Regulations

Our technology to comply with the Insurance Distribution Directive

Insurance Product Information Document (IPID) and suitability and appropriateness test.

If your company works in the area of insurance distribution, these concepts will be familiar to you, especially since the transposition and entry into force of the IDD (Insurance Distribution Directive).

The objective is to reinforce transparency and consumer protection, and that forces you to a complex management, accreditable and with full probative value, in case of direct or judicial claim.

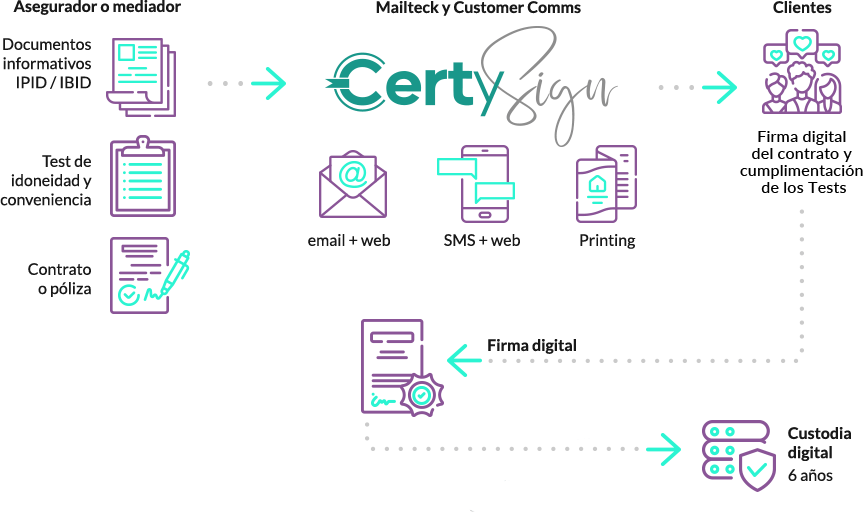

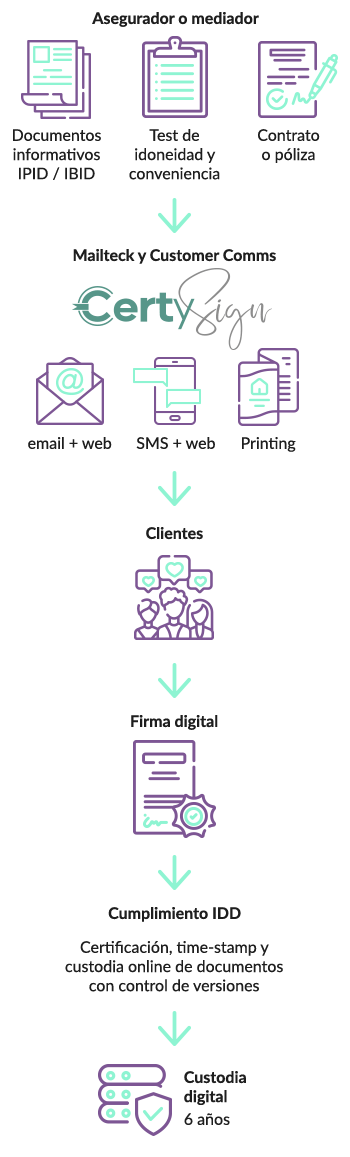

At Customer Comms, we provide your company with an omnichannel solution to comply with the Insurance Distribution Directive with all the guarantees. We generate the IPID, send it through any channel, according to the user’s preferences, and include functionalities such as electronic signature, proof of receipt, digital certification and custody of evidence.

We also submit suitability tests for life insurance based on risky investment products, and manage user responses with a high level of evidence.

Benefits of our solution for IDD Insurance Distribution Directive compliance

![]()

Generate, with the look & feel of your company, IPID and IBIP information documents, suitability and appropriateness tests and contracts in printed or digital formats.

![]()

Distribute documents in an omnichannel way and allow your users to manage them through the device of their choice at any time.

![]()

Improve signature rates and acceptance of terms and conditions.

![]()

Certifies the delivery of IPIDs and IBIPs and integrates the electronic signature in the suitability and convenience tests.

![]()

Custody and digitization of responses and evidence of the process.

Our IDD compliance technology is of interest to you if you are looking for…

- Minimize the risk of non-compliance with IDD regulations and, therefore, of significant penalties.

- Integrate the requirements of the new Insurance Distribution Directive through the advantages of digital transformation.

- Work with a single digital communications and compliance provider, specializing in insurance industry regulations and stakeholders.

- To have the necessary evidence in case of a possible claim from customers or regulators such as AEPD, CNMV, DGSFP or Bank of Spain.

Discover how IDD-compliant legal communications work

Do you want to apply digital transformation to Insurance Distribution Directive compliance?

Frequently Asked Questions

The Insurance Distribution Directive (IDD) is a regulation created to protect the rights of consumers in the insurance sector to which companies in this area of activity must adhere. To comply with it, your company has to carry out a complex and certifiable management of the regulations, which includes elements such as the delivery of the Insurance Product Information Document (IPID) as pre-contractual information and the performance of suitability and appropriateness tests prior to the contracting of certain products.

The main obligations for insurance companies are to provide their clients with the Insurance Product Information Document (IPID) and to carry out suitability and convenience tests prior to contracting certain products in the sector, such as savings and life insurance.

Compliance with the Insurance Distribution Directive is mandatory for the marketing of certain insurance products, such as savings and life insurance products, among others.

Thanks to our technology for European IDD regulations and legal communications, compliance with regulations is guaranteed both by making the necessary documentation and tests available to future customers and by its ability to certify processes, obtain evidence and store it in secure environments.

The IDD obliges companies in the insurance sector to guarantee the right of information to their future clients when marketing products related to savings or life insurance. In the event of non-compliance, penalties may amount to fines of EUR 5 million or 5% of annual turnover for legal entities or EUR 700,000 for individuals.

An expert consultancy with an in-depth knowledge of the European IDD regulations can help your company design the right processes for compliance with the Insurance Distribution Directive (IDD). In addition, MailComms Group combines regulatory expertise with the design, implementation and integration with its customers’ systems of technology that ensures and guarantees their regulatory compliance.