Table of Contents

- How does automation help in the management of claims and collections for companies?

- Online postal bureaufax as a solution for collection automation

- Cases of use of the online postal bureaufax in the management of claims and business collections

- Implementation of an automated postal bureaufax complaint system

- Frequently Asked Questions

The automation of claims and collections in companies through the postal bureaufax allows organizations to streamline one of the most delicate processes in financial management: the follow-up and recovery of unpaid bills.

Thanks to digitalization and the incorporation of tools such as the online postal bureaufax for companies, it is possible to speed up reaction times, reduce manual errors and improve the traceability of actions taken against delinquent customers. We will go into this in more detail below.

This is what you will discover in this article:

- Automation in claims and collections. Save time and reduce errors by managing non-payments with controlled digital flows.

- Digital postal bureaufax with full legal validity for these communications. Communicate formally with your debtors in minutes and with documentary support.

- Common business use cases. From mass claims to personalized follow-ups.

- How to implement the online postal bureaufax system without friction. Easy integration into your company.

And we also invite you to learn about the advantages of using the online postal burofax in personnel management, for dismissal and sanction notifications. We also recommend you to read about a crucial issue in these cases: transparency in your company’s legal notifications, thanks to the burofax.

How does automation help in the management of claims and collections for companies?

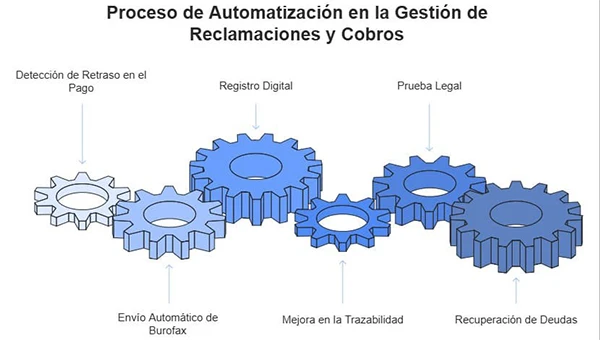

The automation of claims and collections in companies thanks to the online postal bureaufax makes it possible to standardize processes that previously required a lot of time, coordination and manual supervision. Here are some of its advantages:

- Time reduction in the reliable notification of non-payments. Thanks to automatic flows, companies can send formal communications as soon as a delay in payment is detected, without relying on the direct intervention of the team.

- Improved traceability and legal proof of communications. Each shipment is digitally recorded, with acknowledgement of receipt and evidence that can be presented in court if necessary.

- Higher debt recovery rate with less operational effort. By combining immediacy, formality and traceability, the dissuasive impact of the digitally delivered postal burofax for debt collection helps debtors to regularize their situation more quickly.

Online postal bureaufax as a solution for collection automation

The burofax sent through a digital platform is easily integrated with other company systems. Unlike other informal methods such as emails or calls, it offers documentary and legal support from the very first moment. All this contributes to professionalize the collection management without overloading the team.

Read on to learn about the functions of the online postal burofax in the claim and collection processes in companies.

Cases of use of the online postal bureaufax in the management of claims and business collections

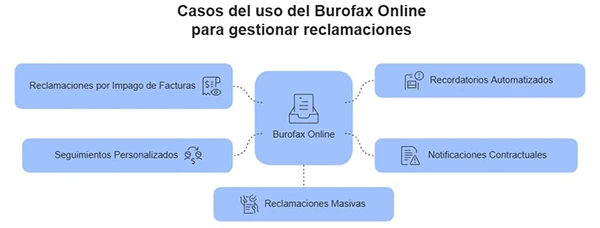

The bureaufax sent by an online platform has multiple applications in the business environment. Some examples are the following.

- Claims for non-payment of invoices. Allows the customer to be formally notified of the due date and payment obligation, leaving a legal record.

- Automated reminders before maturity. Discourages delays without the need for manual intervention.

- Contractual notices of default. In the case of broken business agreements or unfulfilled conditions, the online postal burofax acts as a reliable means of warning.

- Personalized follow-up to clients with a history of delinquency. It enables differentiated and controlled management according to the risk profile.

- Massive claims to customers of recurring services. Very useful in sectors such as telecommunications or insurance claims. insurance claims.

Now, how can the sending of burofaxes by digital means be implemented for the automation of claims in companies? Let’s take a look.

Implementation of an automated claims system with online burofax

Integrating an automated online postal bureaufax-based payment management system does not require large investments or radical changes to your current processes. You simply have to choose the right platform, install it, configure it locally and follow the simple steps that will be indicated to you.

At Mailcomms Group we have the necessary tools to help you implement a claims and collections automation system in your company thanks to the online postal burofax, adapted to the size, sector and specific needs of your business. Our solutions include PostaMail y CertySign.

Do you want to know which of these solutions could be more efficient for your company? Contact us now and we will solve all your doubts.

Frequently Asked Questions

When is it advisable to use the online burofax in a non-payment claim?

The postal burofax sent by means of a digital platform is appropriate when a formal complaint is to be legally recorded or when other methods have proved ineffective. Its use is especially useful from the second request onwards or if legal action is envisaged.

What is the difference between the online postal burofax and other methods of debt collection?

Unlike telephone calls, uncertified e-mails or even registered letters, the digitally delivered postal bureaufax has probative value. Moreover, its deterrent effect is greater, since the recipient understands that it is a serious and registered communication.

Can the online postal bureaufax be integrated with billing and financial management tools?

It depends on the chosen platform, but some of them allow you to connect the online burofax with your current systems, so that the process is automatically activated according to defined rules (due dates, amounts, deadlines…).

Which sectors can benefit the most from automating collections with online bureaufax?

Sectors with a high volume of recurring invoicing or in which the recovery of non-payments is critical: financial services, real estate, insurance companies, management and legal firms, among others.

What mistakes should companies avoid when automating receivables management?

Not reviewing the data before sending, not segmenting by customer profile or not establishing clear rules can lead to ineffective communications or even damage the business relationship. Another mistake to avoid is to choose a tool that does not guarantee security and legal validity in the communication of these charges or claims. For this, the ideal is to opt for specialized service providers, such as MailComms Group.