In the insurance sector, the management of notifications of claims, claims or notices of non-payment with customers and third parties requires methods that guarantee their legal validity.

To confirm that this is the case, the use of the online postal bureaufax for companies is a reliable and efficient alternative. Unlike traditional postal mail, this type of communication allows faster delivery, with certification of content and digital acknowledgement of receipt, reducing costs and optimizing response times .

We will discuss all of this below. This is what you will find in this article:

- Relevance of legal certainty in insurers’ communication. Avoid disputes with customers and third parties thanks to certified notifications.

- Difference between traditional and digital methods. Automation, traceability and security.

- Where to use the online postal bureaufax in the insurance sector. Claims, claims and policy information, among others.

The importance of legal validity in insurance communications

The documentation that insurers work with is made up of a large volume of sensitive information: contracts, insurance claims and other reports with legal implications. For that reason, any notification sent to customers or third parties must be traceable, certified and comply with current regulations.

Facilitate your company’s your company’s insurance claims with our online burofax service.

The reason is simple: a delivery failure or lack of documentary proof can lead to policy challenges, litigation or non-payment. In view of this, using a type of communication such as the digital bureaufax, which guarantees the legal validity of communications with customers and third parties in the insurance sector, is a good solution.

Traditional vs. digital methods in insurance communication

Technological evolution has changed the way insurers manage their notifications. So the question arises: is postal mail still the best option in an industry where speed and certification are essential?

Limitations of postal mail and traditional methods

The registered letter has been for years the usual way to send legal notices, but it has some disadvantages, such as long delivery times in certain occasions and high costs for handling and shipping.

Not sure which service to choose for your legal communications? Discover the key differences between bureaufax and registered letters and choose the option that best suits your company’s needs.

Digitization and automation of notifications

In contrast, the digitization and sending of online communications streamlines processes and reduces costs. With the burofax sent through digital media in communications with customers and third parties within the insurance sector, companies can integrate the service into their internal systems.

This means sending notifications instantly without the need to travel outside the office, as well as obtaining content certification.

How the online postal bureaufax improves traceability and legal certainty

A burofax sent by digital means improves the traceability of legal documents in insurance companies because it provides electronic acknowledgement of receipt and allows verification of the status of the sending. In addition, content certification ensures that the message has not been altered, providing valid proof in the event of a legal dispute.

Read on to find out more about the role of this solution in the insurance industry.

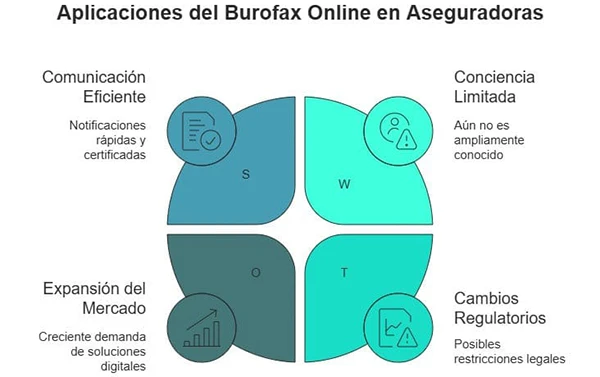

Applications of the digital mailing bureaufax in the insurance industry

Sending of claims and claims notifications

When a claim occurs, speed of communication is essential. With a burofax sent by digital means, the insurer can notify the client with acknowledgement of receipt, ensuring that the client has been informed in a timely manner.

Need to ensure delivery of your important communications? Find out how to bureaufax with acknowledgment of receipt can offer you maximum legal security.

Certified communication in the cancellation and renewal of policies

Changes in policies must always be reported officially. A certified digital burofax allows insurers to legitimize the communication of renewals, cancellations or contractual modifications, avoiding misunderstandings with policyholders.

Legal notices of non-payment and collection management

Non-payments can generate conflicts if they are not properly managed. With a burofax sent through a digital platform, the insurer obtains a certified proof of communication and a debt claim. debt claim, which strengthens its position in the face of possible legal requirements.

Traceability and acknowledgment of receipt in notifications to customers and suppliers

The online bureaufax ensures that all notices have a legally valid acknowledgment of receipt, providing the insurer with a verifiable record of document delivery.

If your insurance company is looking for the most reliable solution for sending legally valid communications to customers and third parties, the digitization of online postal burofaxing is the answer. is the answer.

To do this, you need to have a platform that guarantees these mailings, and MailComms Group offers comprehensive solutions for the implementation of digital mailing bureaufax through platforms such as PostalMail y CertySign.

Contact us now for more information!

Frequently Asked Questions

How can an insurer guarantee the legal validity of its notifications?

To ensure legal validity, the notification must have certification of content, acknowledgement of receipt and traceability. The digitally issued bureaufax offers these elements.

What advantages does the digitally sent burofax have over certified mail in insurance companies?

The online postal bureaufax is faster, as it saves time spent at a post office. It is also more secure and economical. In addition, it offers traceability and certification of the message.

Is it possible to automate the sending of online burofaxes in insurance companies?

Yes. A platform such as PostaMail enables automated online bureaufaxing, providing greater operational efficiency, especially when sending a large volume of communications.

How to choose a suitable digital mailing bureaufax provider for an insurance company?

It is important to choose a provider that, above all, guarantees the legal validity of communications and offers integration with your company’s systems. This is the case with a provider such as MailComms Group.