Table of Contents

- Importance of certified email in the financial sector

- Benefits of using certified email in the financial sector

- Use cases of certified email in the financial sector

- How to implement certified email in a financial company

- Frequently asked questions about the benefits of certified email in the financial sector

It is no secret that the finance industry operates under a constant magnifying glass. Every document, every notification and every movement must be accurately recorded.

In this context, certified email in the financial sector is not only a technological improvement, it is a concrete response to the need to communicate with guarantees, protect sensitive information and demonstrate, without room for doubt, that it has complied with regulatory requirements.

We will discuss these details below:

- Why certified email is so relevant in the financial field. Protection of sensitive data, legal validity and compliance with industry regulatory requirements.

- Practical advantages of certified e-mail for entities. It reduces risks, speeds up processes and improves control of internal and external communications.

- Common day-to-day applications. From contract notices to transaction confirmations.

- What to consider when implementing certified email in your company. Choosing a reliable provider, integrating well with existing systems…

- And, in addition, we invite you to read these two contents on the optimization of contract management through certified email (both in the financial sector and in others) and on its ensuring the GDPR compliance of certified emails in terms of integrity and confidentiality..

Importance of certified email in the financial sector

Protecting digital communications is not only a best practice in finance, it is a way to operate with responsibility and foresight.

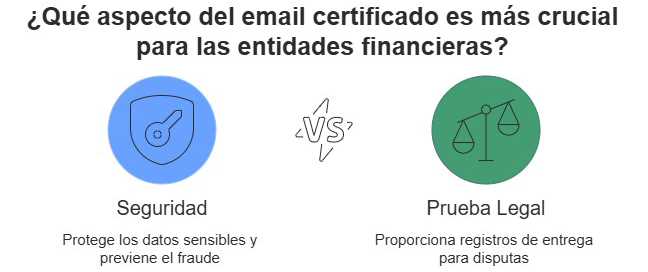

Security in the transmission of sensitive data

Certified email can verify the identity of both the sender and the recipient, preventing unauthorized access and ensuring confidentiality. This is especially critical in the management of accounts, financial transactions or personal customer data.

Legal proof of shipment and receipt

Each certified email leaves a record with a time stamp and evidence of delivery. This allows financial institutions to prove that a communication has been effectively sent and received, which has legal value in the event of any dispute.

Compliance with financial sector regulations

Regulations such as PSD2, the GDPR or the regulations on the prevention of money laundering require specific measures for data protection and traceability of communications.

Certified email in the finance sector facilitates compliance with these legal obligations in an automated manner.

Read on to discover how this kind of certified notification brings tangible benefits to the day-to-day business of financial institutions.

Benefits of using certified email in the financial sector

Adopting certified email means improving not only the security of your financial firm, but also operational efficiency and control. Why? Here’s what it means:

- Reduced risk of fraud and unauthorized access. Each shipment is protected against tampering, ensuring that information reaches only the right people.

- Agility in the management of documents and notifications. By sending a certified email, communications arrive in seconds (under normal circumstances), speeding up processes.

How to send a certified email and make sure it arrives? We tell you about it. - Operational and administrative cost savings. Eliminates the use of paper, physical couriers and reduces time spent tracking deliveries.

- Traceability and control over communications. Every step of the process is recorded, providing full visibility into who has received, opened or interacted with the message.

Read on to find out in which specific situations certified email is successfully applied.

Use cases of certified email in the financial sector

Certified e-mail is a versatile solution with key applications in the daily operations of any entity in the sector.

👉 Improve communication with your policyholders thanks to certified e-mail.

- Notifications to customers about changes in contractual conditions. It allows accrediting that the client has been duly informed, which protects the entity against possible claims.

- Sending bank statements and financial documentation. It guarantees the confidentiality of the information and reduces costs compared to postal mailing.

- Confirmation of operations and authorizations. Facilitates a fast and secure channel for recording transaction, investment or loan approvals.

- Complaint management and dispute resolution. Provides verifiable proof of communication, streamlining legal or internal processes.

Did you know that your e-mails can be key evidence in a trial? Find out how to present them correctly.

If what you have discovered so far interests you for your company, take note of how to implement it.

How to implement certified email in a financial company

Implementing this solution is easier than it sounds by following a few key steps:

- Selection of a safe and reliable supplier. It is essential to opt for a service that complies with industry regulations and offers legally valid certificates. Preferably opt for a platform managed by a QUALIFIED and trustworthy service provider.

- Your customers may require other alternative communication channels to email (WhatsApp, sms, postcard…). Value those platforms that allow you to certify the information through different channels.

- Integration with internal communication systems. It must be compatible with existing mail platforms (Outlook, Gmail, etc.) and with CRM or ERP systems.

- Training and qualification of the team. To take advantage of the full potential of certified e-mail, it is important that users know how and when to use it.

👉 Validity of e-mail communications: legal keys you need to know.

The good news is that at MailComms Group we offer a certified certified email service that meets all these characteristics, adjusted to the financial sector. Our solution, implemented through CertySign, allows you to send emails with full legal validity, complete traceability and maximum security.

Request your demo and we will tell you how certified email will protect your communications and optimize your processes.

Frequently asked questions about the benefits of certified email in the financial sector

Is certified email legally valid in the financial sector?

Yes, it is supported by the European eIDAS standard and provides proof of shipment, delivery and content, which gives it probative value in legal proceedings or audits.

What type of financial documents can be sent by certified email?

Virtually all types of documents: contracts, statements, authorizations, reports, invoices, compliance communications and more.

What advantages does this solution offer over traditional e-mail in the financial sector?

Traditional mail does not offer reliability, legal guarantees or advanced security. Certified email does, and it also allows you to automate processes and reduce costs.

How does this solution help reduce the risk of fraud in the financial sector?

Certified email prevents tampering and provides evidence of every step of communication.

How much does it cost to implement a certified email system in a financial company?

The cost of a certified email service may vary depending on the provider, the level of legal validity it offers, the features included and the volume of contracted mailings. Even so, it usually represents a significant saving compared to more traditional alternatives such as postal mail or bureaufax.